ES Daily Plan | July 10, 2023

The current state of the market on both the daily and weekly is characterized by balance, highlighting the importance of staying nimble and adaptable.

Can the sellers take advantage of Friday's nasty reversal?

Contextual Analysis

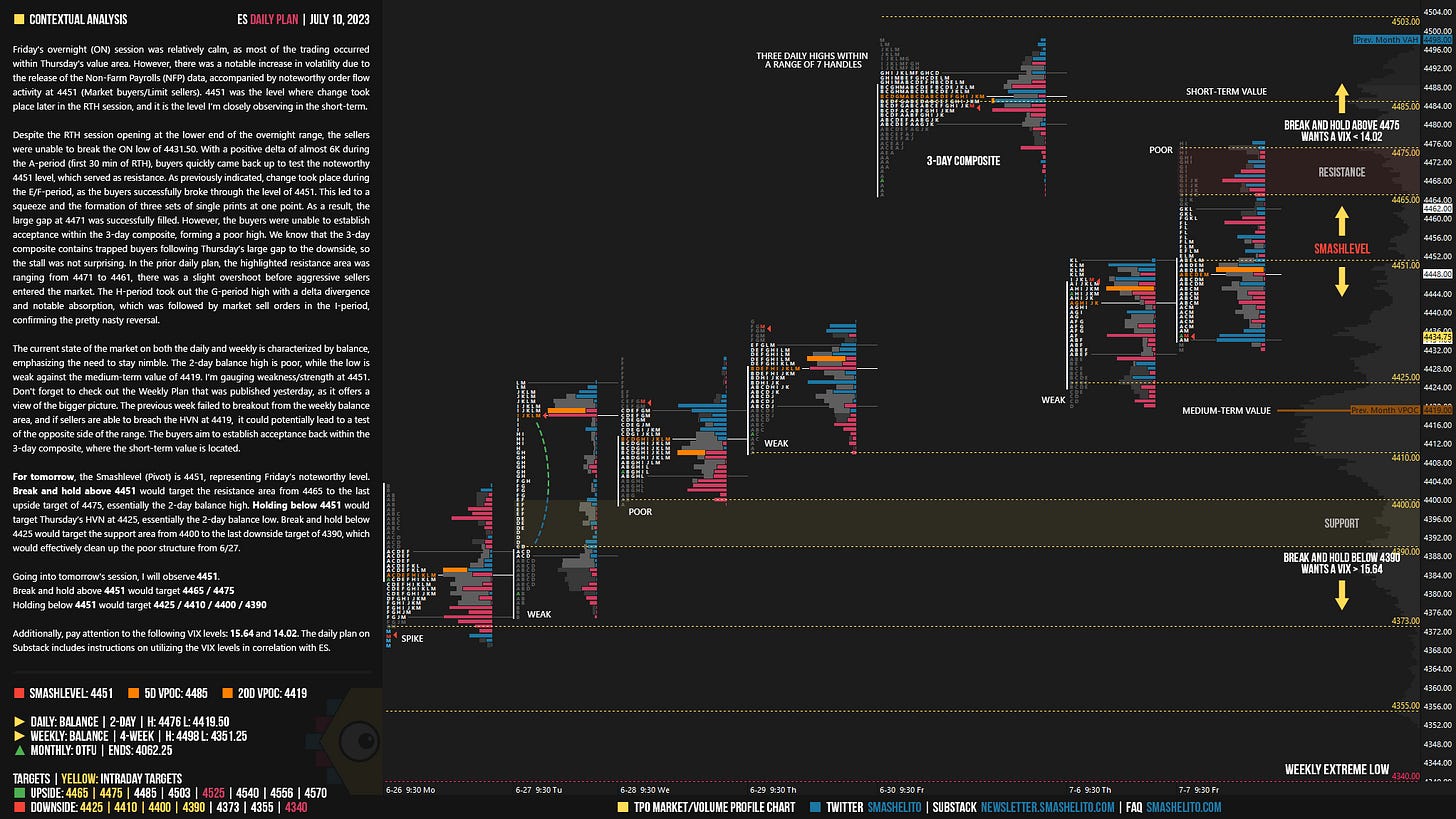

Friday's overnight (ON) session was relatively calm, as most of the trading occurred within Thursday's value area. However, there was a notable increase in volatility due to the release of the Non-Farm Payrolls (NFP) data, accompanied by noteworthy order flow activity at 4451 (Market buyers/Limit sellers). 4451 was the level where change took place later in the RTH session, and it is the level I’m closely observing in the short-term.

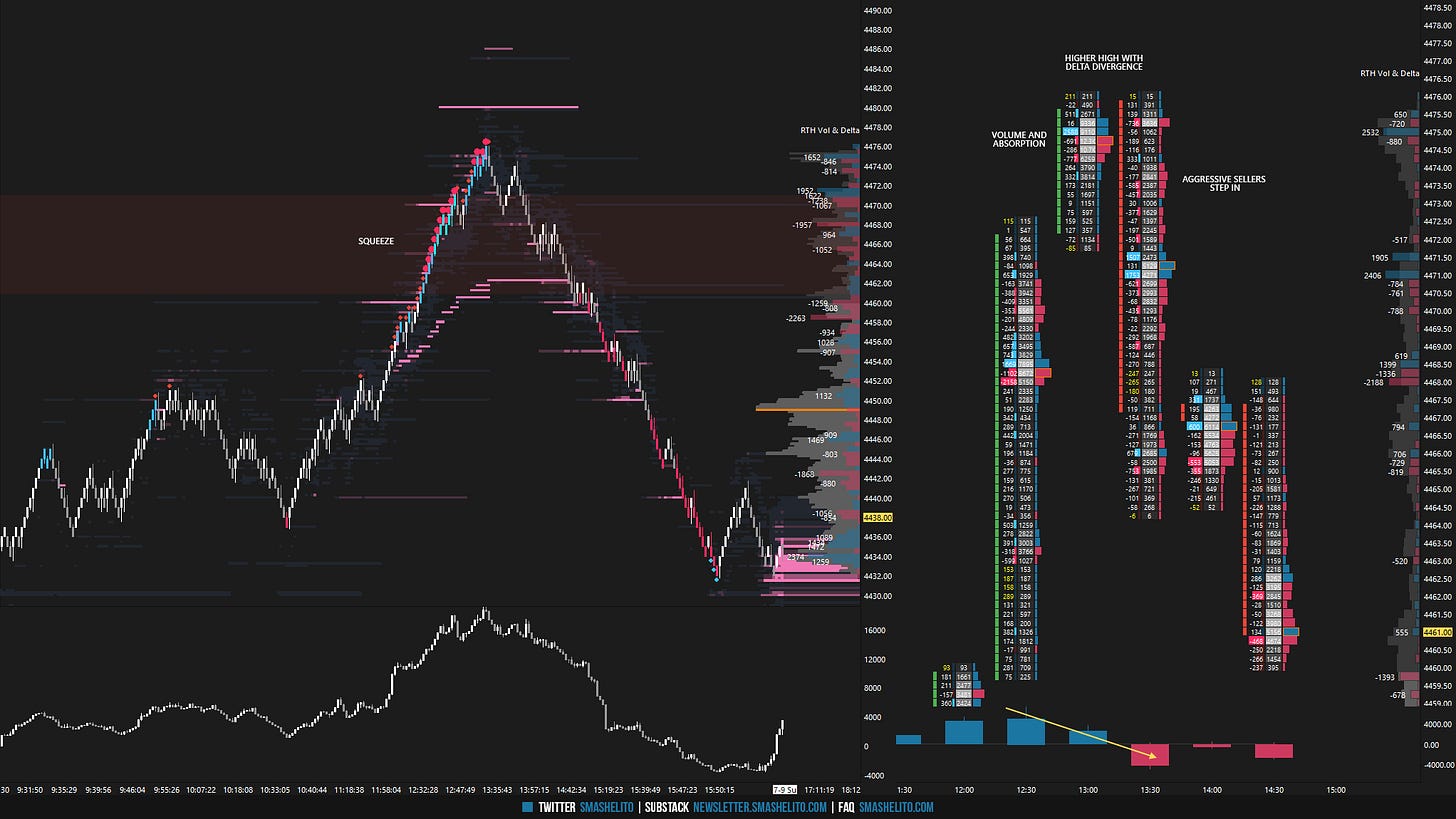

Despite the RTH session opening at the lower end of the overnight range, the sellers were unable to break the ON low of 4431.50. With a positive delta of almost 6K during the A-period (first 30 min of RTH), buyers quickly came back up to test the noteworthy 4451 level, which served as resistance. As previously indicated, change took place during the E/F-period, as the buyers successfully broke through the level of 4451. This led to a squeeze and the formation of three sets of single prints at one point. As a result, the large gap at 4471 was successfully filled. However, the buyers were unable to establish acceptance within the 3-day composite, forming a poor high. We know that the 3-day composite contains trapped buyers following Thursday’s large gap to the downside, so the stall was not surprising. In the prior daily plan, the highlighted resistance area was ranging from 4471 to 4461, there was a slight overshoot before aggressive sellers entered the market. The H-period took out the G-period high with a delta divergence and notable absorption, which was followed by market sell orders in the I-period, confirming the pretty nasty reversal.

The current state of the market on both the daily and weekly is characterized by balance, emphasizing the need to stay nimble. The 2-day balance high is poor, while the low is weak against the medium-term value of 4419. I’m gauging weakness/strength at 4451. Don't forget to check out the Weekly Plan that was published yesterday, as it offers a view of the bigger picture. The previous week failed to breakout from the weekly balance area, and if sellers are able to breach the HVN at 4419, it could potentially lead to a test of the opposite side of the range. The buyers aim to establish acceptance back within the 3-day composite, where the short-term value is located.

For tomorrow, the Smashlevel (Pivot) is 4451, representing Friday’s noteworthy level. Break and hold above 4451 would target the resistance area from 4465 to the last upside target of 4475, essentially the 2-day balance high. Holding below 4451 would target Thursday’s HVN at 4425, essentially the 2-day balance low. Break and hold below 4425 would target the support area from 4400 to the last downside target of 4390, which would effectively clean up the poor structure from 6/27.

Going into tomorrow's session, I will observe 4451.

Break and holdabove 4451 would target 4465 / 4475

Holding below 4451 would target 4425 / 4410 / 4400 / 4390

Additionally, pay attention to the following VIX levels: 15.64 and 14.02. These levels can provide confirmation of strength or weakness.

Break and hold above 4475 with VIX below 14.02 would confirm strength.

Break and hold below 4390 with VIX above 15.64 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.