ES Daily Plan | January 5, 2024

I will use the spike base at 4737 as a short-term reference point to assess the market's strength or weakness.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

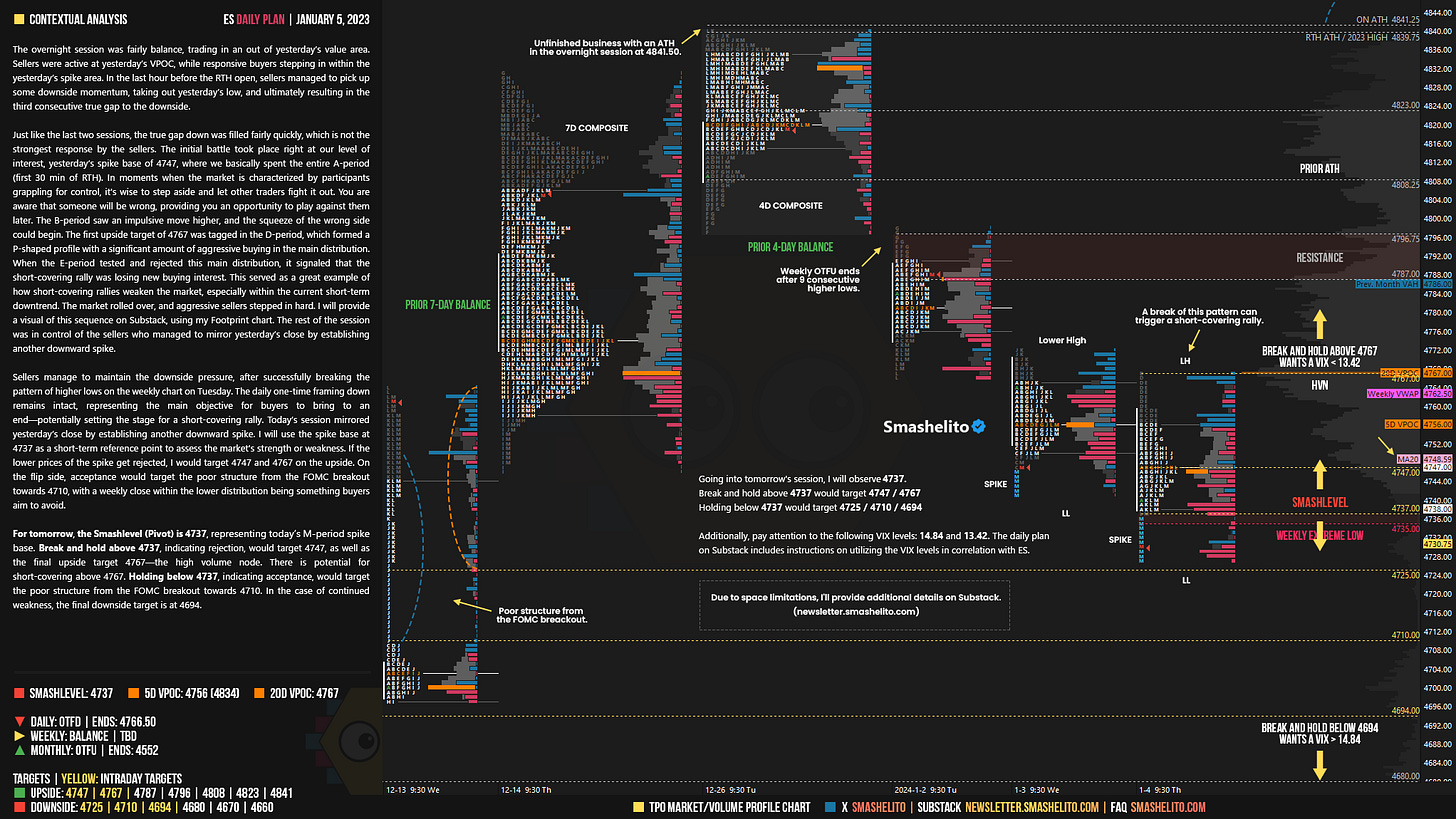

The overnight session was fairly balance, trading in an out of yesterday’s value area. Sellers were active at yesterday’s VPOC, while responsive buyers stepping in within the yesterday’s spike area. In the last hour before the RTH open, sellers managed to pick up some downside momentum, taking out yesterday’s low, and ultimately resulting in the third consecutive true gap to the downside.

Just like the last two sessions, the true gap down was filled fairly quickly, which is not the strongest response by the sellers. The initial battle took place right at our level of interest, yesterday’s spike base of 4747, where we basically spent the entire A-period (first 30 min of RTH). In moments when the market is characterized by participants grappling for control, it's wise to step aside and let other traders fight it out. You are aware that someone will be wrong, providing you an opportunity to play against them later. The B-period saw an impulsive move higher, and the squeeze of the wrong side could begin. The first upside target of 4767 was tagged in the D-period, which formed a P-shaped profile with a significant amount of aggressive buying in the main distribution. When the E-period tested and rejected this main distribution, it signaled that the short-covering rally was losing new buying interest. This served as a great example of how short-covering rallies weaken the market, especially within the current short-term downtrend. The market rolled over, and aggressive sellers stepped in hard. I will provide a visual of this sequence on Substack, using my Footprint chart. The rest of the session was in control of the sellers who managed to mirror yesterday’s close by establishing another downward spike.

Sellers manage to maintain the downside pressure, after successfully breaking the pattern of higher lows on the weekly chart on Tuesday. The daily one-time framing down remains intact, representing the main objective for buyers to bring to an end—potentially setting the stage for a short-covering rally. Today’s session mirrored yesterday’s close by establishing another downward spike. I will use the spike base at 4737 as a short-term reference point to assess the market's strength or weakness. If the lower prices of the spike get rejected, I would target 4747 and 4767 on the upside. On the flip side, acceptance would target the poor structure from the FOMC breakout towards 4710, with a weekly close within the lower distribution being something buyers aim to avoid.

Upon observing the composite profile to the far right, the primary distribution is evident, ranging from approximately 4840 to 4740. Currently trading below this distribution, it is not an optimal location for sellers. Additionally, we have cleared all weekly downside targets to 4735, adding another layer of caution against being overly aggressive as a seller here. Despite the prevailing downside pressure, sellers have struggled to maintain gaps or establish any trend days, and the downward momentum is slowing down with overlapping value. Having said that, if you’ve had a successful week on the short side, it’s not a bad idea to step aside and observe. Needless to say, this doesn't rule out a potential downside continuation; just exercise caution, especially if sellers struggle to hold below 4735.

From yesterday, still relevant: In addition to monitoring intraday VIX levels, keep an eye on 14.02 for the rest of the week. Holding above it increases the odds of 4735 getting tagged. In other words, if VIX remains above 14.02 and ES stays below 4735, there is potential for further weakness.

For tomorrow, the Smashlevel (Pivot) is 4737, representing today’s M-period spike base. Break and hold above 4737, indicating rejection, would target 4747, as well as the final upside target 4767—the high volume node. There is potential for short-covering above 4767. Holding below 4737, indicating acceptance, would target the poor structure from the FOMC breakout towards 4710. In the case of continued weakness, the final downside target is at 4694.

Levels of Interest

Going into tomorrow's session, I will observe 4737.

Break and hold above 4737 would target 4747 / 4767

Holding below 4737 would target 4725 / 4710 / 4694

Additionally, pay attention to the following VIX levels: 14.84 and 13.42. These levels can provide confirmation of strength or weakness.

Break and hold above 4767 with VIX below 13.42 would confirm strength.

Break and hold below 4694 with VIX above 14.84 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

While always deeply technically informative, this write up is one of the best yet. Defining terms briefly, noting the competitive implications of an imbalance - "You are aware that someone will be wrong, providing you an opportunity to play against them later." - this is just great. Thank you, as always, for consistently excellent analysis.

Thank you as always!