ES Daily Plan | January 4, 2024

I will use the spike base at 4747 as a short-term reference point to assess the market's strength or weakness.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

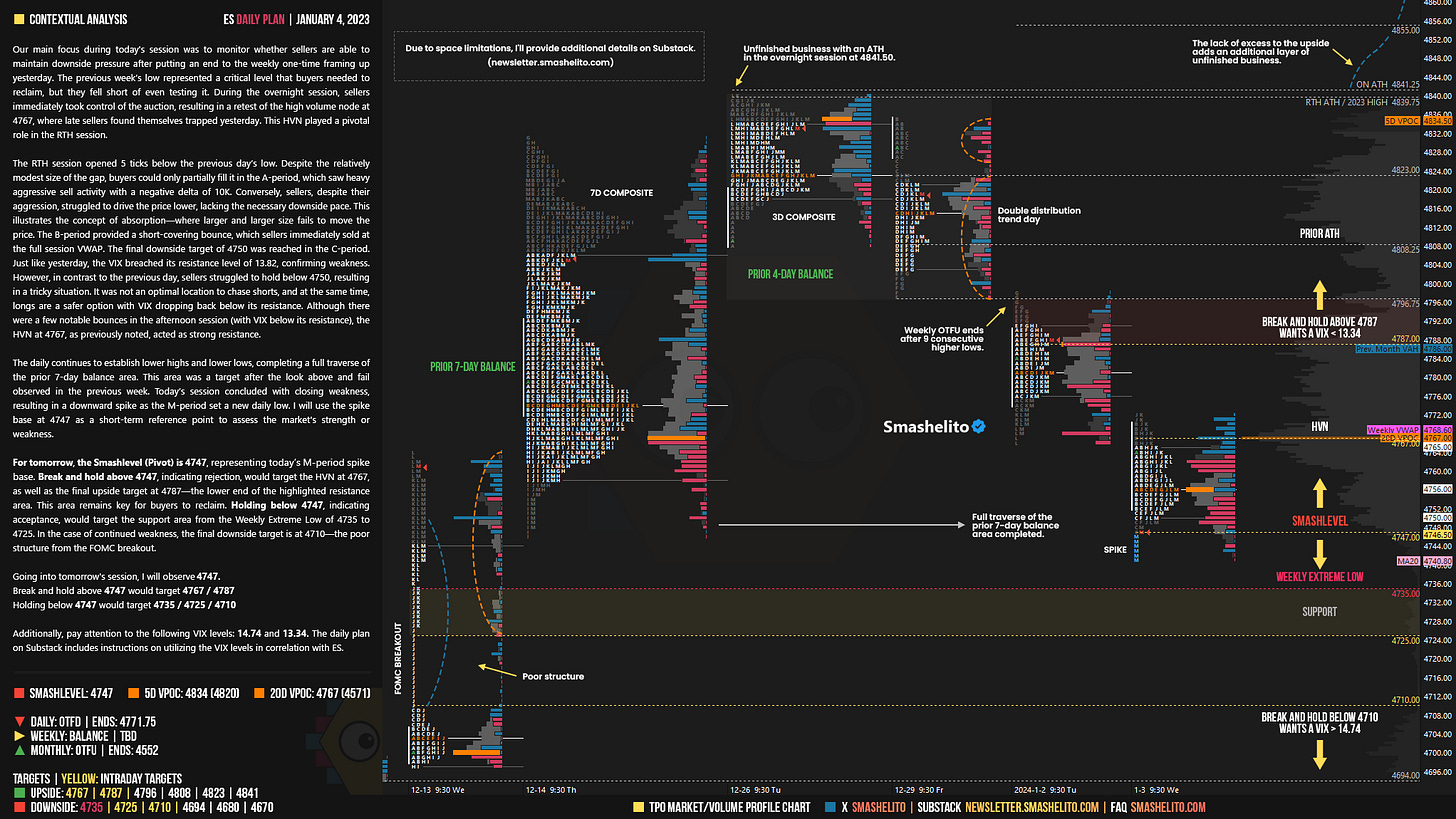

Our main focus during today's session was to monitor whether sellers are able to maintain downside pressure after putting an end to the weekly one-time framing up yesterday. The previous week’s low represented a critical level that buyers needed to reclaim, but they fell short of even testing it. During the overnight session, sellers immediately took control of the auction, resulting in a retest of the high volume node at 4767, where late sellers found themselves trapped yesterday. This HVN played a pivotal role in the RTH session.

The RTH session opened 5 ticks below the previous day’s low. Despite the relatively modest size of the gap, buyers could only partially fill it in the A-period, which saw heavy aggressive sell activity with a negative delta of 10K. Conversely, sellers, despite their aggression, struggled to drive the price lower, lacking the necessary downside pace. This illustrates the concept of absorption—where larger and larger size fails to move the price. The B-period provided a short-covering bounce, which sellers immediately sold at the full session VWAP. The final downside target of 4750 was reached in the C-period. Just like yesterday, the VIX breached its resistance level of 13.82, confirming weakness. However, in contrast to the previous day, sellers struggled to hold below 4750, resulting in a tricky situation. It was not an optimal location to chase shorts, and at the same time, longs are a safer option with VIX dropping back below its resistance. Although there were a few notable bounces in the afternoon session (with VIX below its resistance), the HVN at 4767, as previously noted, acted as strong resistance.

The daily continues to establish lower highs and lower lows, completing a full traverse of the prior 7-day balance area. This area was a target after the look above and fail observed in the previous week. Today’s session concluded with closing weakness, resulting in a downward spike as the M-period set a new daily low. I will use the spike base at 4747 as a short-term reference point to assess the market's strength or weakness.

Furthermore, the medium-term value (20D VPOC) has shifted from 4571 to 4767. Currently, the short-term value (5D VPOC) is situated at 4834. Sellers are aiming to lower the 5D VPOC to confirm the recent downside move.

During today's session, we fell 6 handles short of testing the Weekly Extreme Low of 4735. As always, the closer we get to 4735, the less favorable the trade location is for shorts on a weekly basis. Having said that, stay flexible and adjust your target expectations for the rest of the week. Unfinished business at the ATH still remains.

It's worth noting that both NQ (16622) and RTY (1981) have reached their respective Weekly Extreme Lows, both closing below. Whether this implies that ES will test 4735 remains to be seen. Clues will come from the Acceptance or Rejection of the lower price of today's spike. As mentioned in the Weekly Plan, the sellers' most favorable scenario involves a weekly close below 4735.

In addition to monitoring intraday VIX levels, keep an eye on 14.02 for the rest of the week. Holding above it increases the odds of 4735 getting tagged. In other words, if VIX remains above 14.02 and ES stays below 4735, there is potential for further weakness.

For tomorrow, the Smashlevel (Pivot) is 4747, representing today’s M-period spike base. Break and hold above 4747, indicating rejection, would target the HVN at 4767, as well as the final upside target at 4787—the lower end of the highlighted resistance area. This area remains key for buyers to reclaim. Holding below 4747, indicating acceptance, would target the support area from the Weekly Extreme Low of 4735 to 4725. In the case of continued weakness, the final downside target is at 4710—the poor structure from the FOMC breakout.

Levels of Interest

Going into tomorrow's session, I will observe 4747.

Break and hold above 4747 would target 4767 / 4787

Holding below 4747 would target 4735 / 4725 / 4710

Additionally, pay attention to the following VIX levels: 14.74 and 13.34. These levels can provide confirmation of strength or weakness.

Break and hold above 4787 with VIX below 13.34 would confirm strength.

Break and hold below 4710 with VIX above 14.74 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you buddy. Another green day. Had some losses in the morning my fault but gained prior 2PM FED mins.

Thank you!