ES Daily Plan | January 23, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

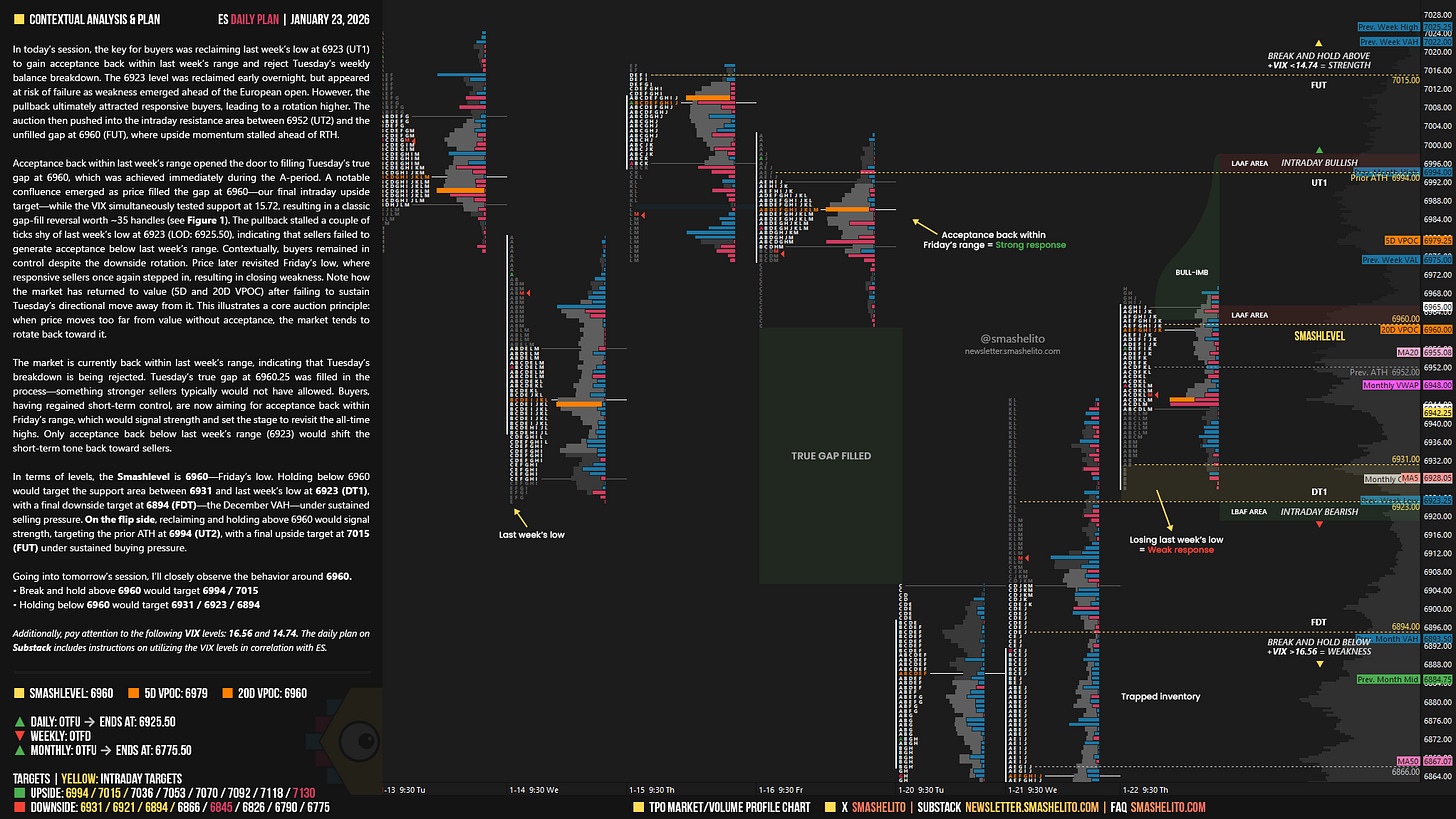

In today’s session, the key for buyers was reclaiming last week’s low at 6923 (UT1) to gain acceptance back within last week’s range and reject Tuesday’s weekly balance breakdown. The 6923 level was reclaimed early overnight, but appeared at risk of failure as weakness emerged ahead of the European open. However, the pullback ultimately attracted responsive buyers, leading to a rotation higher. The auction then pushed into the intraday resistance area between 6952 (UT2) and the unfilled gap at 6960 (FUT), where upside momentum stalled ahead of RTH.

Acceptance back within last week’s range opened the door to filling Tuesday’s true gap at 6960, which was achieved immediately during the A-period. A notable confluence emerged as price filled the gap at 6960—our final intraday upside target—while the VIX simultaneously tested support at 15.72, resulting in a classic gap-fill reversal worth ~35 handles (see Figure 1). The pullback stalled a couple of ticks shy of last week’s low at 6923 (LOD: 6925.50), indicating that sellers failed to generate acceptance below last week’s range. Contextually, buyers remained in control despite the downside rotation. Price later revisited Friday’s low, where responsive sellers once again stepped in, resulting in closing weakness. Note how the market has returned to value (5D and 20D VPOC) after failing to sustain Tuesday’s directional move away from it. This illustrates a core auction principle: when price moves too far from value without acceptance, the market tends to rotate back toward it.

The market is currently back within last week’s range, indicating that Tuesday’s breakdown is being rejected. Tuesday’s true gap at 6960.25 was filled in the process—something stronger sellers typically would not have allowed.

Buyers, having regained short-term control, are now aiming for acceptance back within Friday’s range, which would signal strength and set the stage to revisit the all-time highs.

Only acceptance back below last week’s range (6923) would shift the short-term tone back toward sellers.

In terms of levels, the Smashlevel is 6960—Friday’s low. Holding below 6960 would target the support area between 6931 and last week’s low at 6923 (DT1), with a final downside target at 6894 (FDT)—the December VAH—under sustained selling pressure.

On the flip side, reclaiming and holding above 6960 would signal strength, targeting the prior ATH at 6994 (UT2), with a final upside target at 7015 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6960.

Break and hold above 6960 would target 6994 / 7015

Holding below 6960 would target 6931 / 6923 / 6894

Additionally, pay attention to the following VIX levels: 16.56 and 14.74. These levels can provide confirmation of strength or weakness.

Break and hold above 7015 with VIX below 14.74 would confirm strength.

Break and hold below 6894 with VIX above 16.56 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Absolutely amazing how you do this. Grateful is all I can say!

<<yes, absolutely great content, it's completely unbelievable that this kind of quality is waiting for me in my inbox every morning. You can learn something from every newsletter, one of the better contents. Thanks Smash for everything...>>

I second that. Couldn’t have expressed it better myself. Truly appreciated. Thank you.