ES Daily Plan | January 22, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

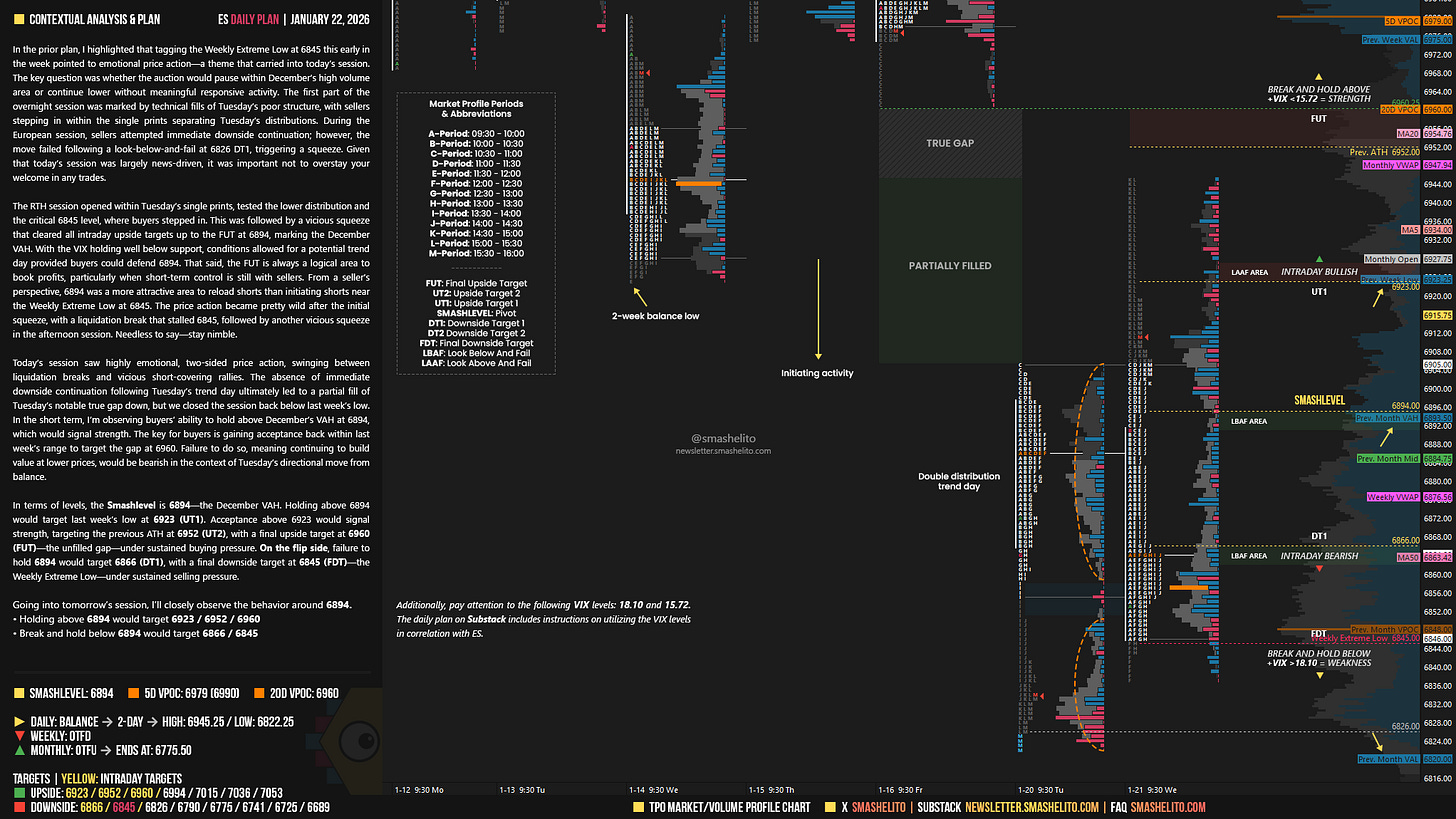

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

In the prior plan, I highlighted that tagging the Weekly Extreme Low at 6845 this early in the week pointed to emotional price action—a theme that carried into today’s session. The key question was whether the auction would pause within December’s high volume area or continue lower without meaningful responsive activity. The first part of the overnight session was marked by technical fills of Tuesday’s poor structure, with sellers stepping in within the single prints separating Tuesday’s distributions. During the European session, sellers attempted immediate downside continuation; however, the move failed following a look-below-and-fail at 6826 DT1, triggering a squeeze. Given that today’s session was largely news-driven, it was important not to overstay your welcome in any trades.

The RTH session opened within Tuesday’s single prints, tested the lower distribution and the critical 6845 level, where buyers stepped in. This was followed by a vicious squeeze that cleared all intraday upside targets up to the FUT at 6894, marking the December VAH. With the VIX holding well below support, conditions allowed for a potential trend day provided buyers could defend 6894. That said, the FUT is always a logical area to book profits, particularly when short-term control is still with sellers. From a seller’s perspective, 6894 was a more attractive area to reload shorts than initiating shorts near the Weekly Extreme Low at 6845. The price action became pretty wild after the initial squeeze, with a liquidation break that stalled 6845, followed by another vicious squeeze in the afternoon session. Needless to say—stay nimble.

Today’s session saw highly emotional, two-sided price action, swinging between liquidation breaks and vicious short-covering rallies.

The absence of immediate downside continuation following Tuesday’s trend day ultimately led to a partial fill of Tuesday’s notable true gap down, but we closed the session back below last week’s low.

In the short term, I’m observing buyers’ ability to hold above December’s VAH at 6894, which would signal strength. The key for buyers is gaining acceptance back within last week’s range to target the gap at 6960.

Failure to do so, meaning continuing to build value at lower prices, would be bearish in the context of Tuesday’s directional move from balance.

In terms of levels, the Smashlevel is 6894—the December VAH. Holding above 6894 would target last week’s low at 6923 (UT1). Acceptance above 6923 would signal strength, targeting the previous ATH at 6952 (UT2), with a final upside target at 6960 (FUT)—the unfilled gap—under sustained buying pressure.

On the flip side, failure to hold 6894 would target 6866 (DT1), with a final downside target at 6845 (FDT)—the Weekly Extreme Low—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6894.

Holding above 6894 would target 6923 / 6952 / 6960

Break and hold below 6894 would target 6866 / 6845

Additionally, pay attention to the following VIX levels: 18.10 and 15.72. These levels can provide confirmation of strength or weakness.

Break and hold above 6960 with VIX below 15.72 would confirm strength.

Break and hold below 6845 with VIX above 18.10 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

I noticed the smash level is a LVN for today's profile and a HVN for the previous days composite. Is that something you took into consideration, or we're you going purely off of the December VAH?

Great stuff, Smash! Levels always delivering.