ES Daily Plan | January 2, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Happy 2026! New year, new opportunities—let’s navigate it together.

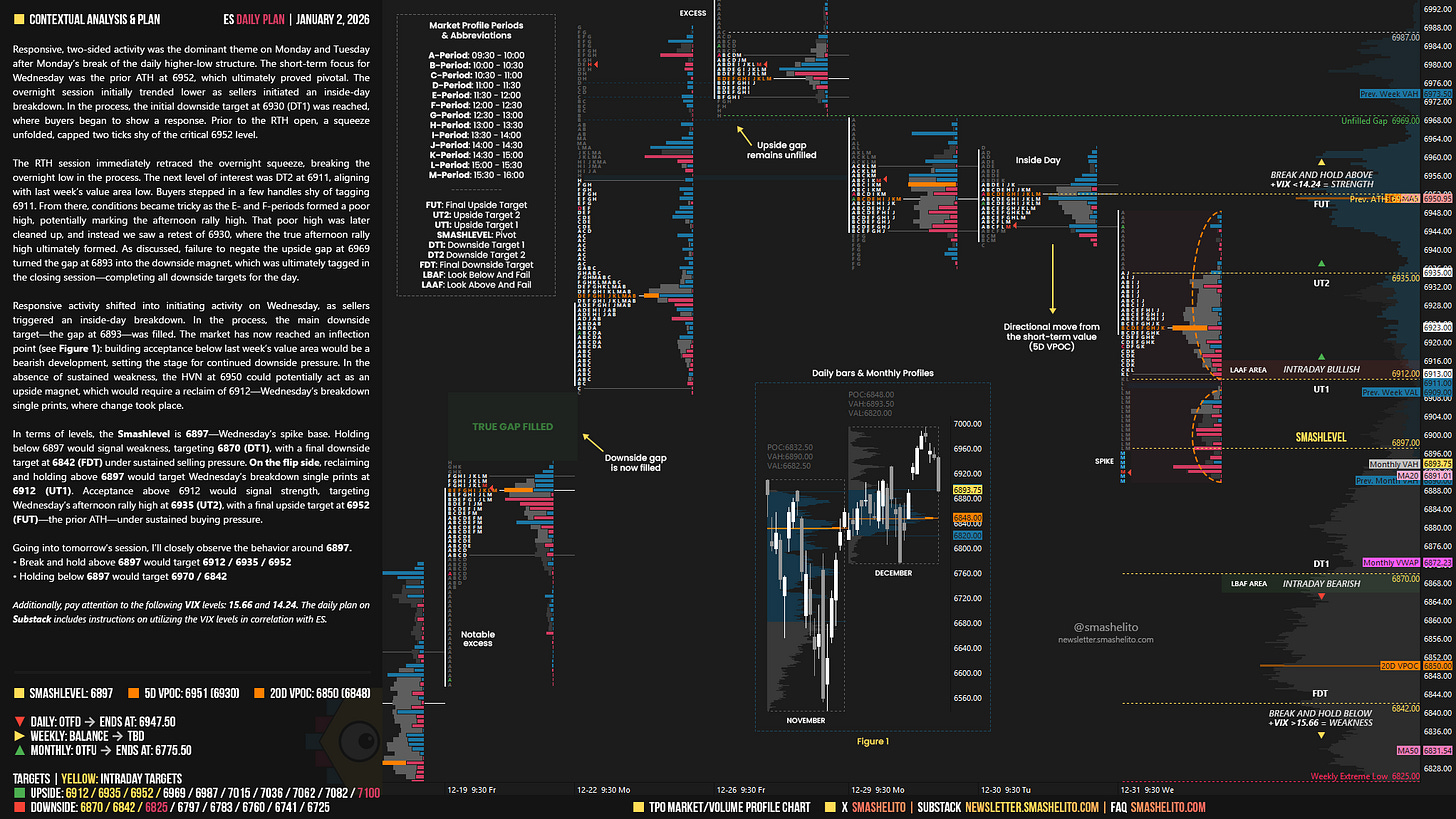

Contextual Analysis & Plan

Responsive, two-sided activity was the dominant theme on Monday and Tuesday after Monday’s break of the daily higher-low structure. The short-term focus for Wednesday was the prior ATH at 6952, which ultimately proved pivotal. The overnight session initially trended lower as sellers initiated an inside-day breakdown. In the process, the initial downside target at 6930 (DT1) was reached, where buyers began to show a response. Prior to the RTH open, a squeeze unfolded, capped two ticks shy of the critical 6952 level.

The RTH session immediately retraced the overnight squeeze, breaking the overnight low in the process. The next level of interest was DT2 at 6911, aligning with last week’s value area low. Buyers stepped in a few handles shy of tagging 6911. From there, conditions became tricky as the E- and F-periods formed a poor high, potentially marking the afternoon rally high. That poor high was later cleaned up, and instead we saw a retest of 6930, where the true afternoon rally high ultimately formed. As discussed, failure to negate the upside gap at 6969 turned the gap at 6893 into the downside magnet, which was ultimately tagged in the closing session—completing all downside targets for the day.

Responsive activity shifted into initiating activity on Wednesday, as sellers triggered an inside-day breakdown. In the process, the main downside target—the gap at 6893—was filled.

The market has now reached an inflection point (see Figure 1): building acceptance below last week’s value area would be a bearish development, setting the stage for continued downside pressure.

In the absence of sustained weakness, the HVN at 6950 could potentially act as an upside magnet, which would require a reclaim of 6912—Wednesday’s breakdown single prints, where change took place.

In terms of levels, the Smashlevel is 6897—Wednesday’s spike base. Holding below 6897 would signal weakness, targeting 6870 (DT1), with a final downside target at 6842 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6897 would target Wednesday’s breakdown single prints at 6912 (UT1). Acceptance above 6912 would signal strength, targeting Wednesday’s afternoon rally high at 6935 (UT2), with a final upside target at 6952 (FUT)—the prior ATH—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6897.

Break and hold above 6897 would target 6912 / 6935 / 6952

Holding below 6897 would target 6970 / 6842

Additionally, pay attention to the following VIX levels: 15.66 and 14.24. These levels can provide confirmation of strength or weakness.

Break and hold above 6952 with VIX below 14.24 would confirm strength.

Break and hold below 6842 with VIX above 15.66 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

No idea how I found you, but excellent analysis. Was the lower end supposed to be 6870 methinks?

Great stuff as usual. Happy new Year Smash