ES Daily Plan | January 19/20, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

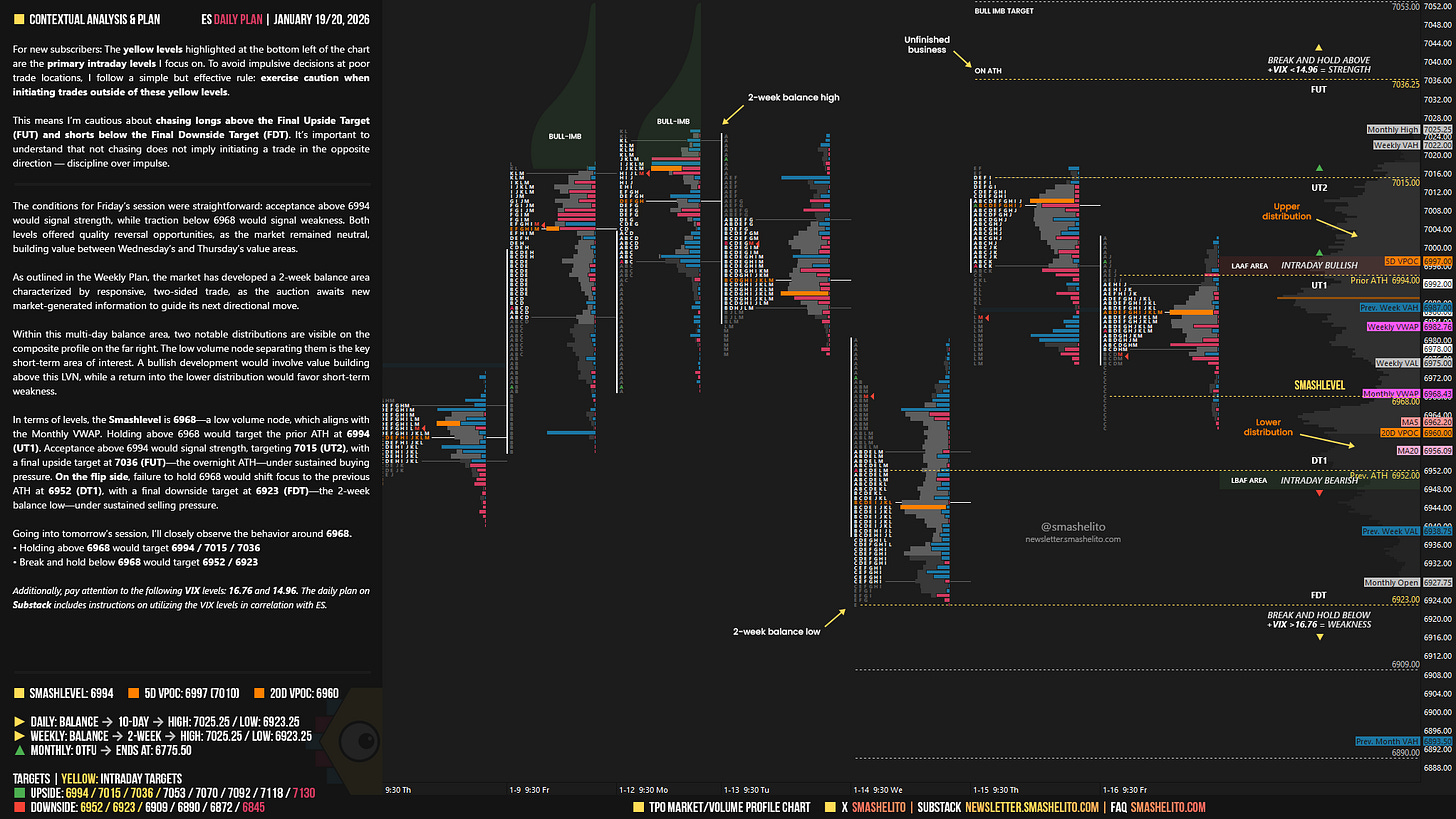

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The conditions for Friday’s session were straightforward: acceptance above 6994 would signal strength, while traction below 6968 would signal weakness. Both levels offered quality reversal opportunities, as the market remained neutral, building value between Wednesday’s and Thursday’s value areas.

As outlined in the Weekly Plan, the market has developed a 2-week balance area characterized by responsive, two-sided trade, as the auction awaits new market-generated information to guide its next directional move.

Within this multi-day balance area, two notable distributions are visible on the composite profile on the far right. The low volume node separating them is the key short-term area of interest. A bullish development would involve value building above this LVN, while a return into the lower distribution would favor short-term weakness.

In terms of levels, the Smashlevel is 6968—a low volume node, which aligns with the Monthly VWAP. Holding above 6968 would target the prior ATH at 6994 (UT1). Acceptance above 6994 would signal strength, targeting 7015 (UT2), with a final upside target at 7036 (FUT)—the overnight ATH—under sustained buying pressure.

On the flip side, failure to hold 6968 would shift focus to the previous ATH at 6952 (DT1), with a final downside target at 6923 (FDT)—the 2-week balance low—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6968.

Holding above 6968 would target 6994 / 7015 / 7036

Break and hold below 6968 would target 6952 / 6923

Additionally, pay attention to the following VIX levels: 16.76 and 14.96. These levels can provide confirmation of strength or weakness.

Break and hold above 7036 with VIX below 14.96 would confirm strength.

Break and hold below 6923 with VIX above 16.76 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash! Interesting open!

How do I get the blue and red circles of different sizes on my chart? What kind of indicator is that. Thanks.