ES Daily Plan | January 15, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

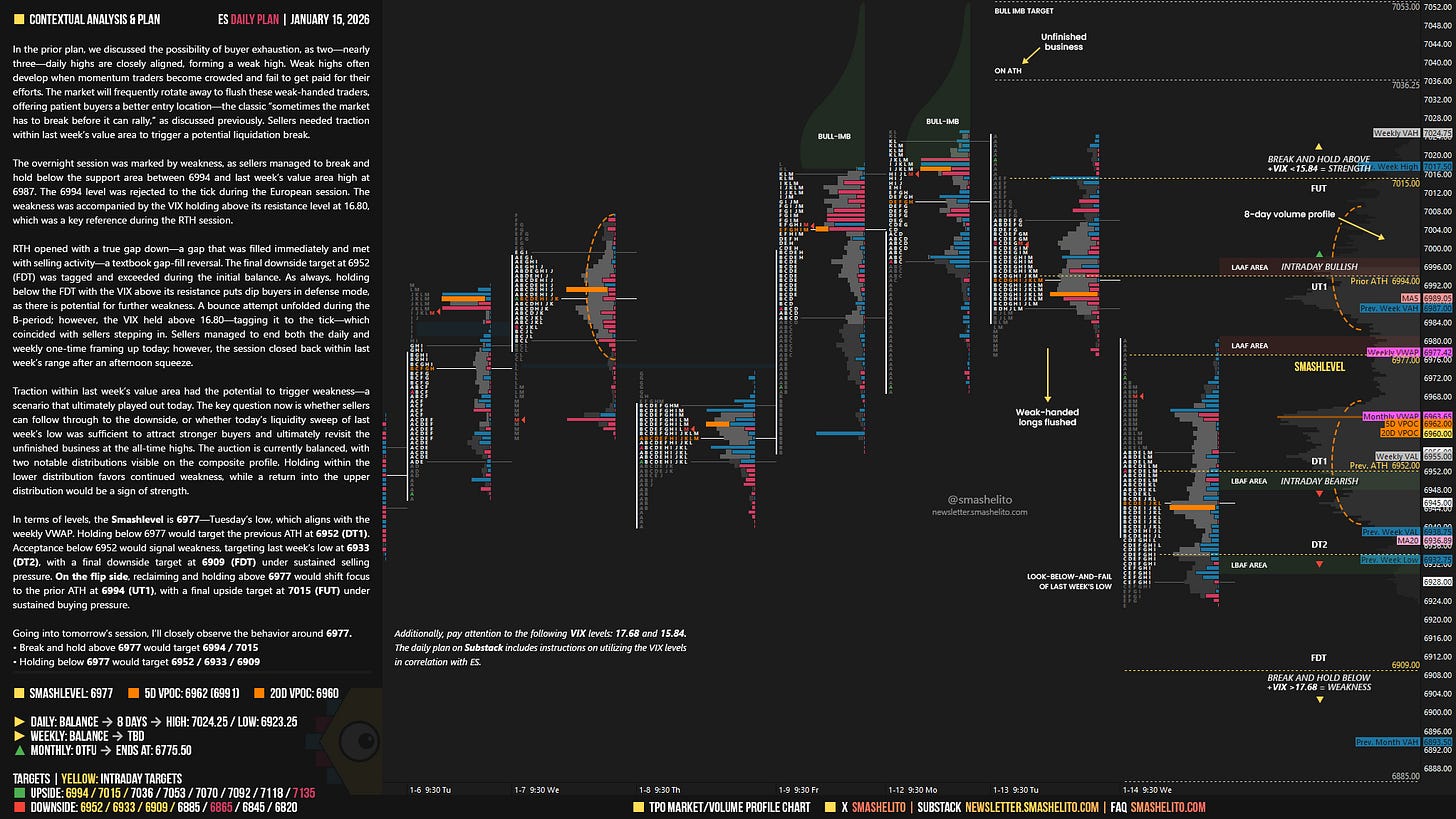

In the prior plan, we discussed the possibility of buyer exhaustion, as two—nearly three—daily highs are closely aligned, forming a weak high. Weak highs often develop when momentum traders become crowded and fail to get paid for their efforts. The market will frequently rotate away to flush these weak-handed traders, offering patient buyers a better entry location—the classic “sometimes the market has to break before it can rally,” as discussed previously. Sellers needed traction within last week’s value area to trigger a potential liquidation break.

The overnight session was marked by weakness, as sellers managed to break and hold below the support area between 6994 and last week’s value area high at 6987. The 6994 level was rejected to the tick during the European session. The weakness was accompanied by the VIX holding above its resistance level at 16.80, which was a key reference during the RTH session.

RTH opened with a true gap down—a gap that was filled immediately and met with selling activity—a textbook gap-fill reversal. The final downside target at 6952 (FDT) was tagged and exceeded during the initial balance. As always, holding below the FDT with the VIX above its resistance puts dip buyers in defense mode, as there is potential for further weakness. A bounce attempt unfolded during the B-period; however, the VIX held above 16.80—tagging it to the tick—which coincided with sellers stepping in. Sellers managed to end both the daily and weekly one-time framing up today; however, the session closed back within last week’s range after an afternoon squeeze.

Traction within last week’s value area had the potential to trigger weakness—a scenario that ultimately played out today. The key question now is whether sellers can follow through to the downside, or whether today’s liquidity sweep of last week’s low was sufficient to attract stronger buyers and ultimately revisit the unfinished business at the all-time highs.

The auction is currently balanced, with two notable distributions visible on the composite profile. Holding within the lower distribution favors continued weakness, while a return into the upper distribution would be a sign of strength.

In terms of levels, the Smashlevel is 6977—Tuesday’s low, which aligns with the weekly VWAP. Holding below 6977 would target the previous ATH at 6952 (DT1). Acceptance below 6952 would signal weakness, targeting last week’s low at 6933 (DT2), with a final downside target at 6909 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6977 would shift focus to the prior ATH at 6994 (UT1), with a final upside target at 7015 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6977.

Break and hold above 6977 would target 6994 / 7015

Holding below 6977 would target 6952 / 6933 / 6909

Additionally, pay attention to the following VIX levels: 17.68 and 15.84. These levels can provide confirmation of strength or weakness.

Break and hold above 7015 with VIX below 15.84 would confirm strength.

Break and hold below 6909 with VIX above 17.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Hey Smash, sorry for all of my questions haha.

I have my MP on tick increment of 4. So on 4 ticks right now the profile is showing poor/weak highs. But if I change to 1, 2, or 3, ticks obviously the details become finer and the poor/weak highs aren't there.

Is it okay to trust the poor highs on 4 ticks? The reason I'm on 4 ticks is because if I'm on 1 tick the letters are way to small and I struggle to fit multiple profiles on the chart while being able to see the letters.

Thanks!

Thank you Smash!