ES Daily Plan | January 14, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

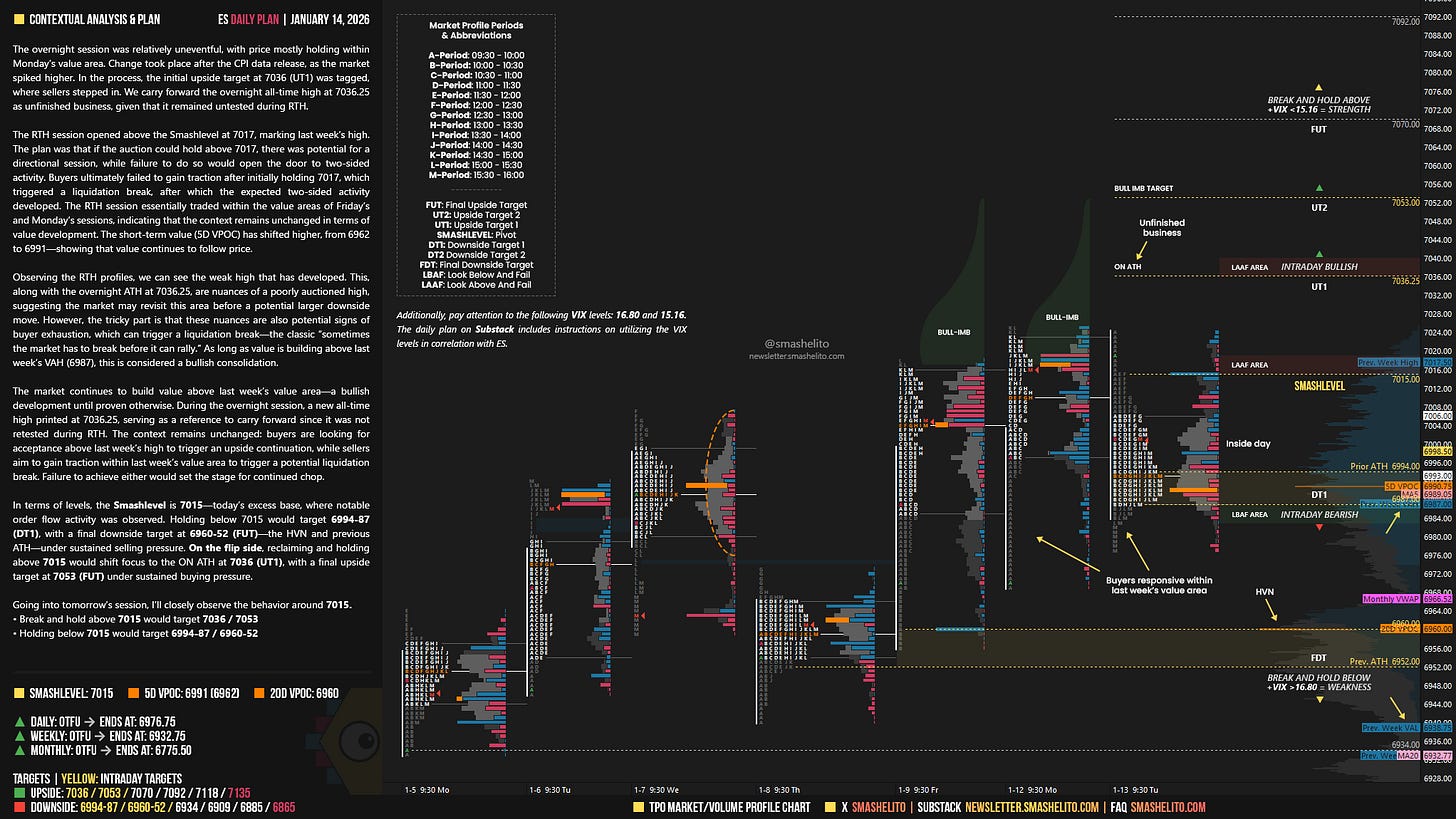

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The overnight session was relatively uneventful, with price mostly holding within Monday’s value area. Change took place after the CPI data release, as the market spiked higher. In the process, the initial upside target at 7036 (UT1) was tagged, where sellers stepped in. We carry forward the overnight all-time high at 7036.25 as unfinished business, given that it remained untested during RTH.

The RTH session opened above the Smashlevel at 7017, marking last week’s high. The plan was that if the auction could hold above 7017, there was potential for a directional session, while failure to do so would open the door to two-sided activity. Buyers ultimately failed to gain traction after initially holding 7017, which triggered a liquidation break, after which the expected two-sided activity developed. The RTH session essentially traded within the value areas of Friday’s and Monday’s sessions, indicating that the context remains unchanged in terms of value development. The short-term value (5D VPOC) has shifted higher, from 6962 to 6991—showing that value continues to follow price.

Observing the RTH profiles, we can see the weak high that has developed. This, along with the overnight ATH at 7036.25, are nuances of a poorly auctioned high, suggesting the market may revisit this area before a potential larger downside move. However, the tricky part is that these nuances are also potential signs of buyer exhaustion, which can trigger a liquidation break—the classic “sometimes the market has to break before it can rally.” As long as value is building above last week’s VAH (6987), this is considered a bullish consolidation.

The market continues to build value above last week’s value area—a bullish development until proven otherwise. During the overnight session, a new all-time high printed at 7036.25, serving as a reference to carry forward since it was not retested during RTH. The context remains unchanged: buyers are looking for acceptance above last week’s high to trigger an upside continuation, while sellers aim to gain traction within last week’s value area to trigger a potential liquidation break. Failure to achieve either would set the stage for continued chop.

In terms of levels, the Smashlevel is 7015—today’s excess base, where notable order flow activity was observed. Holding below 7015 would target 6994-87 (DT1), with a final downside target at 6960-52 (FUT)—the HVN and previous ATH—under sustained selling pressure.

On the flip side, reclaiming and holding above 7015 would shift focus to the ON ATH at 7036 (UT1), with a final upside target at 7053 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 7015.

Break and hold above 7015 would target 7036 / 7053

Holding below 7015 would target 6994-87 / 6960-52

Additionally, pay attention to the following VIX levels: 16.80 and 15.16. These levels can provide confirmation of strength or weakness.

Break and hold above 7053 with VIX below 15.16 would confirm strength.

Break and hold below 6960-52 with VIX above 16.80 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

That 7036 level was nice! Thanks!

Have a great session. I appreciate your knowledge.