ES Daily Plan | February 9, 2023

Today's session resulted in an inside day, forming a double distribution with one set of single prints. The general rule is to go with the break of the inside day.

We continue to consolidate above the FOMC breakout.

Contextual Analysis

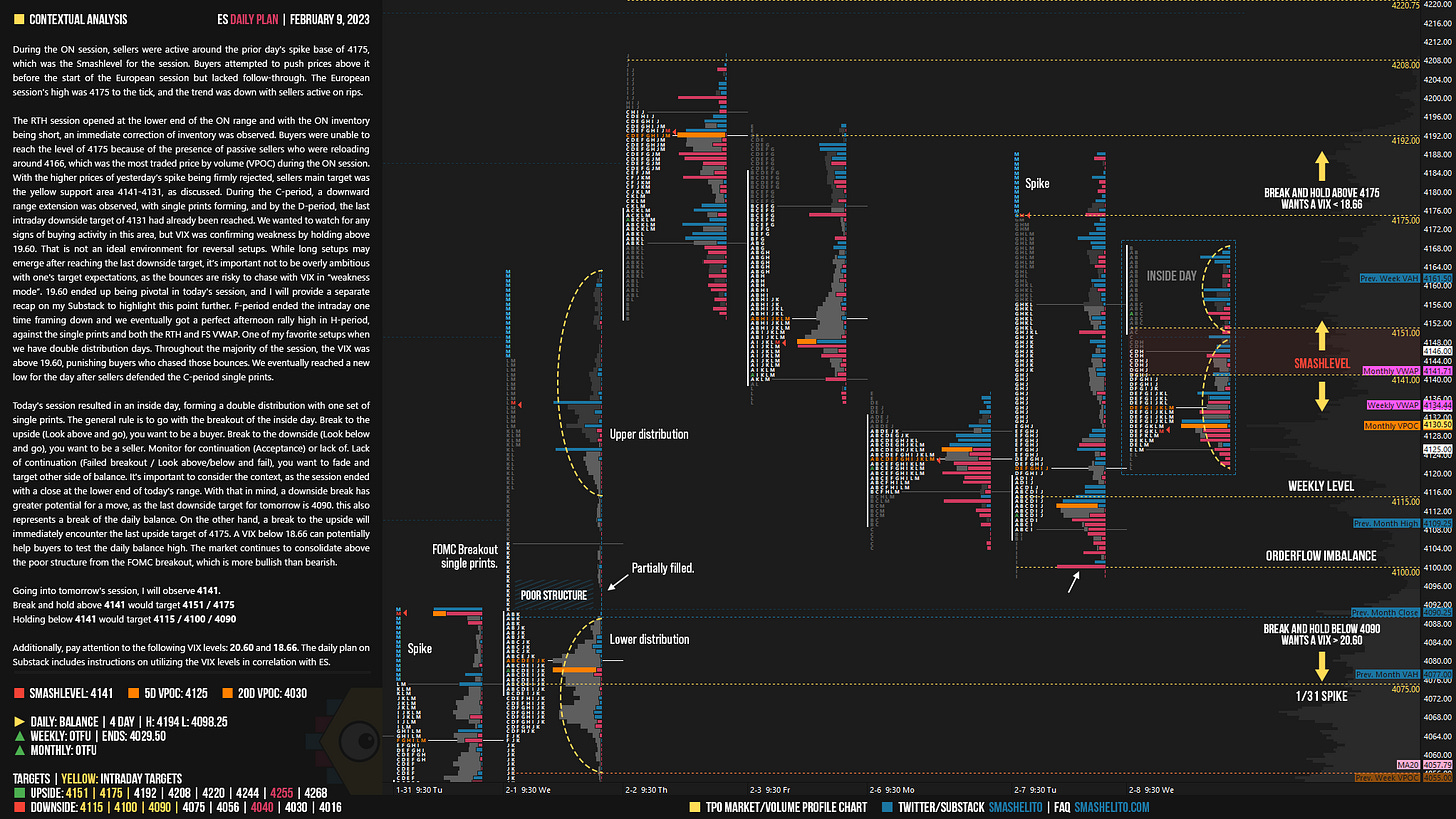

During the ON session, sellers were active around the prior day's spike base of 4175, which was the Smashlevel for the session. Buyers attempted to push prices above it before the start of the European session but lacked follow-through. The European session's high was 4175 to the tick, and the trend was down with sellers active on rips.

The RTH session opened at the lower end of the ON range and with the ON inventory being short, an immediate correction of inventory was observed. Buyers were unable to reach the level of 4175 because of the presence of passive sellers who were reloading around 4166, which was the most traded price by volume (VPOC) during the ON session. With the higher prices of yesterday’s spike being firmly rejected, sellers main target was the yellow support area 4141-4131, as discussed. During the C-period, a downward range extension was observed, with single prints forming, and by the D-period, the last intraday downside target of 4131 had already been reached. We wanted to watch for any signs of buying activity in this area, but VIX was confirming weakness by holding above 19.60. That is not an ideal environment for reversal setups. While long setups may emerge after reaching the last downside target, it’s important not to be overly ambitious with one's target expectations, as the bounces are risky to chase with VIX in “weakness mode”. 19.60 ended up being pivotal in today's session, and I will provide a separate recap on my Substack to highlight this point further. F-period ended the intraday one time framing down and we eventually got a perfect afternoon rally high in H-period, against the single prints and both the RTH and FS VWAP. One of my favorite setups when we have double distribution days. Throughout the majority of the session, the VIX was above 19.60, punishing buyers who chased those bounces. We eventually reached a new low for the day after sellers defended the C-period single prints.

Today's session resulted in an inside day, forming a double distribution with one set of single prints. The general rule is to go with the breakout of the inside day. Break to the upside (Look above and go), you want to be a buyer. Break to the downside (Look below and go), you want to be a seller. Monitor for continuation (Acceptance) or lack of. Lack of continuation (Failed breakout / Look above/below and fail), you want to fade and target other side of balance. It's important to consider the context, as the session ended with a close at the lower end of today's range. With that in mind, a downside break has greater potential for a move, as the last downside target for tomorrow is 4090. this also represents a break of the daily balance. On the other hand, a break to the upside will immediately encounter the last upside target of 4175. A VIX below 18.66 can potentially help buyers to test the daily balance high. The market continues to consolidate above the poor structure from the FOMC breakout, which is more bullish than bearish.

Going into tomorrow's session, I will observe 4141.

Break and hold above 4141 would target 4151 / 4175

Holding below 4141 would target 4115 / 4100 / 4090

Additionally, pay attention to the following VIX levels: 20.60 and 18.66. These levels can provide confirmation of strength or weakness.

Break and hold above 4175 with VIX below 18.66 would confirm strength.

Break and hold below 4090 with VIX above 20.60 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

thank you

Thank you!