ES Daily Plan | February 6, 2023

The daily is in a 2 day balance as sellers managed to breach Thursday’s low on Friday.

The main focus will be on the prior monthly balance high and the poor structure from Wednesday’s FOMC breakout single prints.

Contextual Analysis

As known, I didn’t trade after Tuesday's session. Hence, I’m providing a summary of the last three days of last week, taken from the Weekly Plan published yesterday.

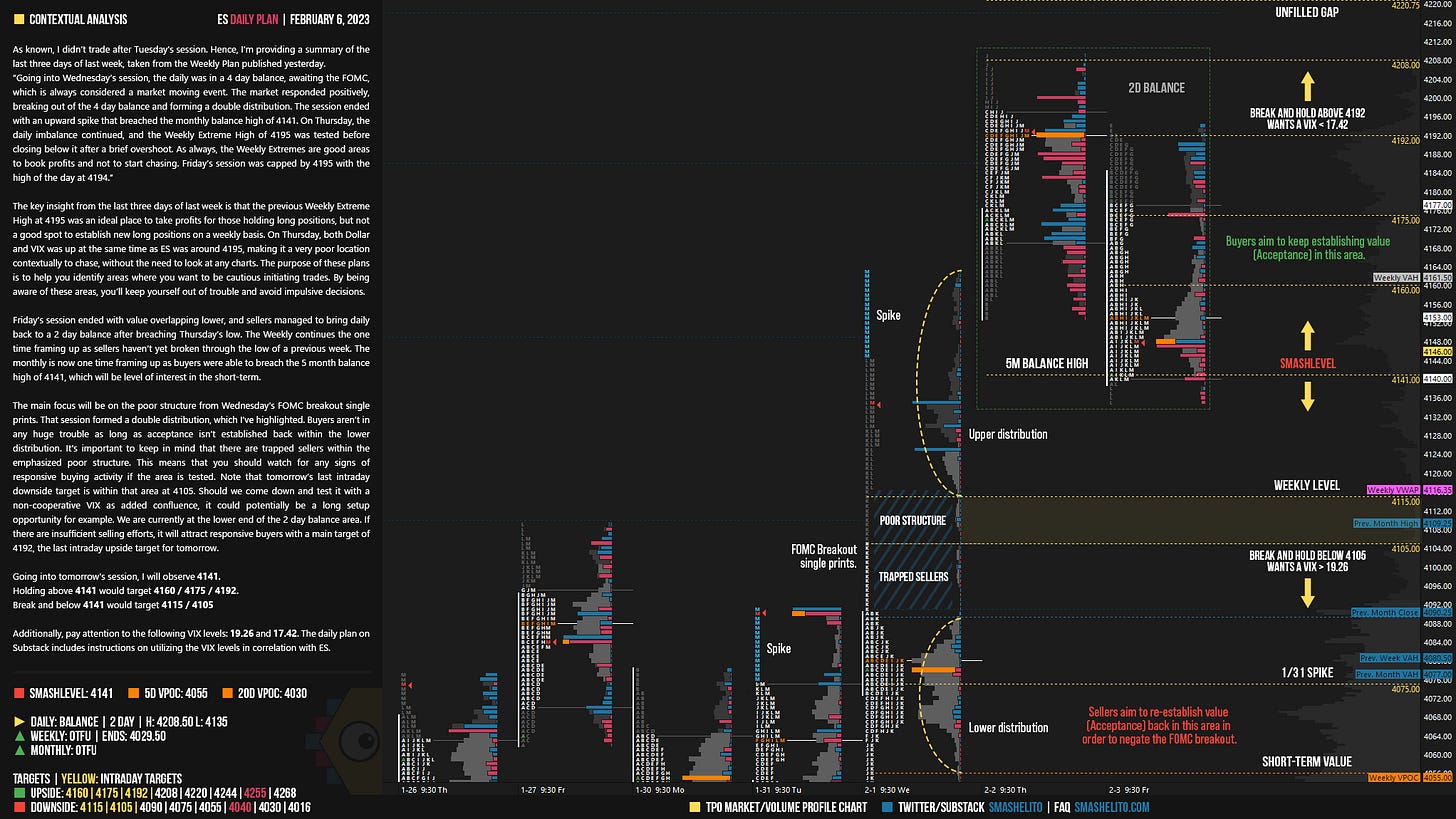

“Going into Wednesday’s session, the daily was in a 4 day balance, awaiting the FOMC, which is always considered a market moving event. The market responded positively, breaking out of the 4 day balance and forming a double distribution. The session ended with an upward spike that breached the monthly balance high of 4141. On Thursday, the daily imbalance continued, and the Weekly Extreme High of 4195 was tested before closing below it after a brief overshoot. As always, the Weekly Extremes are good areas to book profits and not to start chasing. Friday’s session was capped by 4195 with the high of the day at 4194.”

The key insight from the last three days of last week is that the previous Weekly Extreme High at 4195 was an ideal place to take profits for those holding long positions, but not a good spot to establish new long positions on a weekly basis. On Thursday, both Dollar and VIX was up at the same time as ES was around 4195, making it a very poor location contextually to chase, without the need to look at any charts. The purpose of these plans is to help you identify areas where you want to be cautious initiating trades. By being aware of these areas, you’ll keep yourself out of trouble and avoid impulsive decisions.

Friday’s session ended with value overlapping lower, and sellers managed to bring daily back to a 2 day balance after breaching Thursday’s low. The Weekly continues the one time framing up as sellers haven’t yet broken through the low of a previous week. The monthly is now one time framing up as buyers were able to breach the 5 month balance high of 4141, which will be level of interest in the short-term.

The main focus will be on the poor structure from Wednesday’s FOMC breakout single prints. That session formed a double distribution, which I’ve highlighted. Buyers aren’t in any huge trouble as long as acceptance isn’t established back within the lower distribution. It's important to keep in mind that there are trapped sellers within the emphasized poor structure. This means that you should watch for any signs of responsive buying activity if the area is tested. Note that tomorrow’s last intraday downside target is within that area at 4105. Should we come down and test it with a non-cooperative VIX as added confluence, it could potentially be a long setup opportunity for example. We are currently at the lower end of the 2 day balance area. If there are insufficient selling efforts, it will attract responsive buyers with a main target of 4192, the last intraday upside target for tomorrow.

Going into tomorrow's session, I will observe 4141.

Holding above 4141 would target 4160 / 4175 / 4192.

Break and hold below 4141 would target 4115 / 4105.

Additionally, pay attention to the following VIX levels: 19.26 and 17.42. These levels can provide confirmation of strength or weakness.

Break and hold above 4192 with VIX below 17.42 would confirm strength.

Break and hold below 4105 with VIX above 19.26 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Hey Smash! So glad to see you back in the saddle!

Thank you for the new newsletter.

In the profile of 2/3, below 4141 is Excees low, but I wonder why there is no mention of it. Isn't it an excess of a single print area? aggressive sellers were absorbed there.