ES Daily Plan | February 5, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

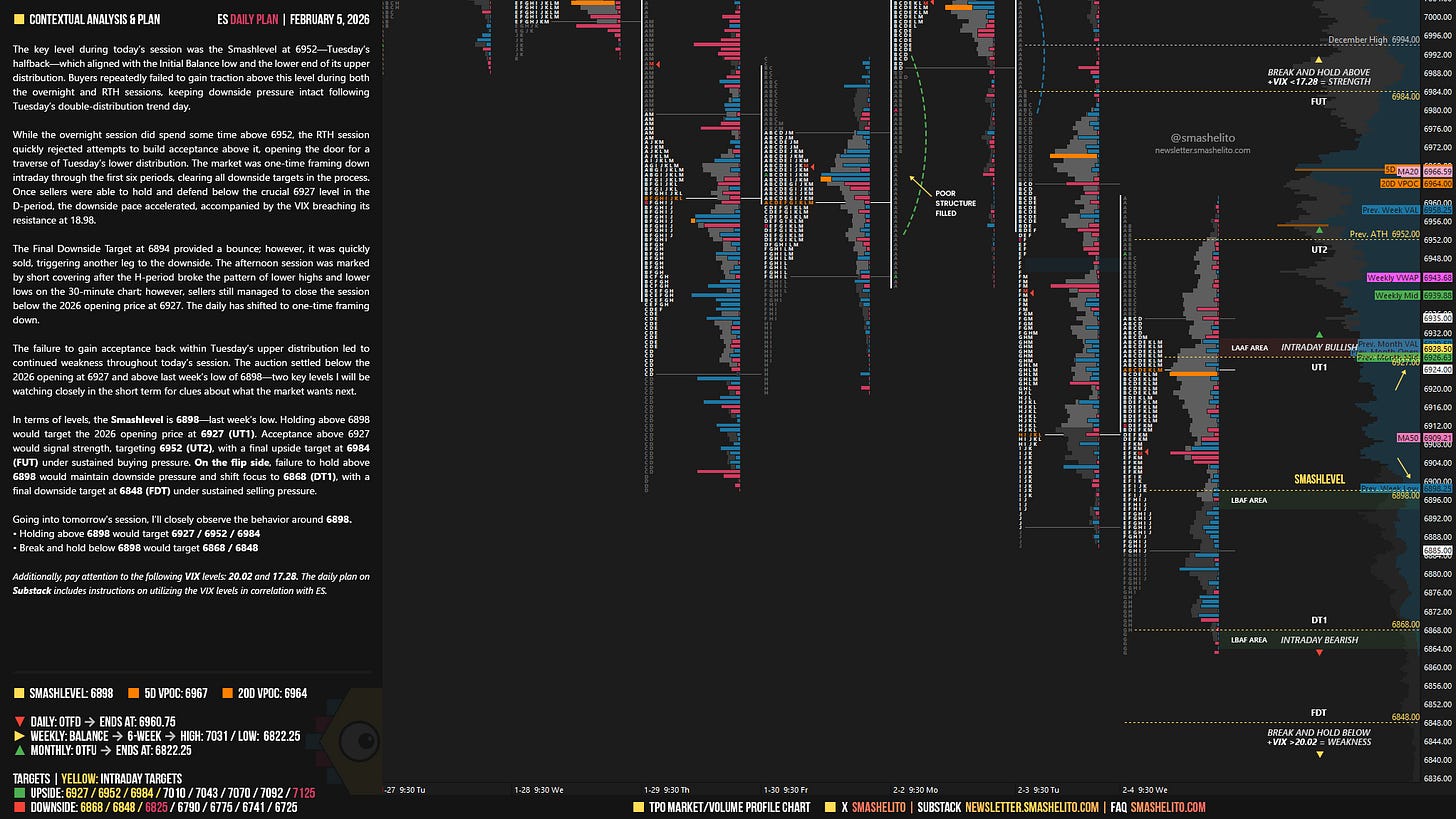

The key level during today’s session was the Smashlevel at 6952—Tuesday’s halfback—which aligned with the Initial Balance low and the lower end of its upper distribution. Buyers repeatedly failed to gain traction above this level during both the overnight and RTH sessions, keeping downside pressure intact following Tuesday’s double-distribution trend day.

While the overnight session did spend some time above 6952, the RTH session quickly rejected attempts to build acceptance above it, opening the door for a traverse of Tuesday’s lower distribution. The market was one-time framing down intraday through the first six periods, clearing all downside targets in the process. Once sellers were able to hold and defend below the crucial 6927 level in the D-period, the downside pace accelerated, accompanied by the VIX breaching its resistance at 18.98.

The Final Downside Target at 6894 provided a bounce; however, it was quickly sold, triggering another leg to the downside. The afternoon session was marked by short covering after the H-period broke the pattern of lower highs and lower lows on the 30-minute chart; however, sellers still managed to close the session below the 2026 opening price at 6927. The daily has shifted to one-time framing down.

The failure to gain acceptance back within Tuesday’s upper distribution led to continued weakness throughout today’s session. The auction settled below the 2026 opening at 6927 and above last week’s low of 6898—two key levels I will be watching closely in the short term for clues about what the market wants next.

In terms of levels, the Smashlevel is 6898—last week’s low. Holding above 6898 would target the 2026 opening price at 6927 (UT1). Acceptance above 6927 would signal strength, targeting 6952 (UT2), with a final upside target at 6984 (FUT) under sustained buying pressure.

On the flip side, failure to hold above 6898 would maintain downside pressure and shift focus to 6868 (DT1), with a final downside target at 6848 (FDT) under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6898.

Holding above 6898 would target 6927 / 6952 / 6984

Break and hold below 6898 would target 6868 / 6848

Additionally, pay attention to the following VIX levels: 20.02 and 17.28. These levels can provide confirmation of strength or weakness.

Break and hold above 6984 with VIX below 17.28 would confirm strength.

Break and hold below 6848 with VIX above 20.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks smash, have a great session

Thanks Smash! The market has been pretty tough the last few days, why do I feel like we're in a rollover week...