ES Daily Plan | February 4, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

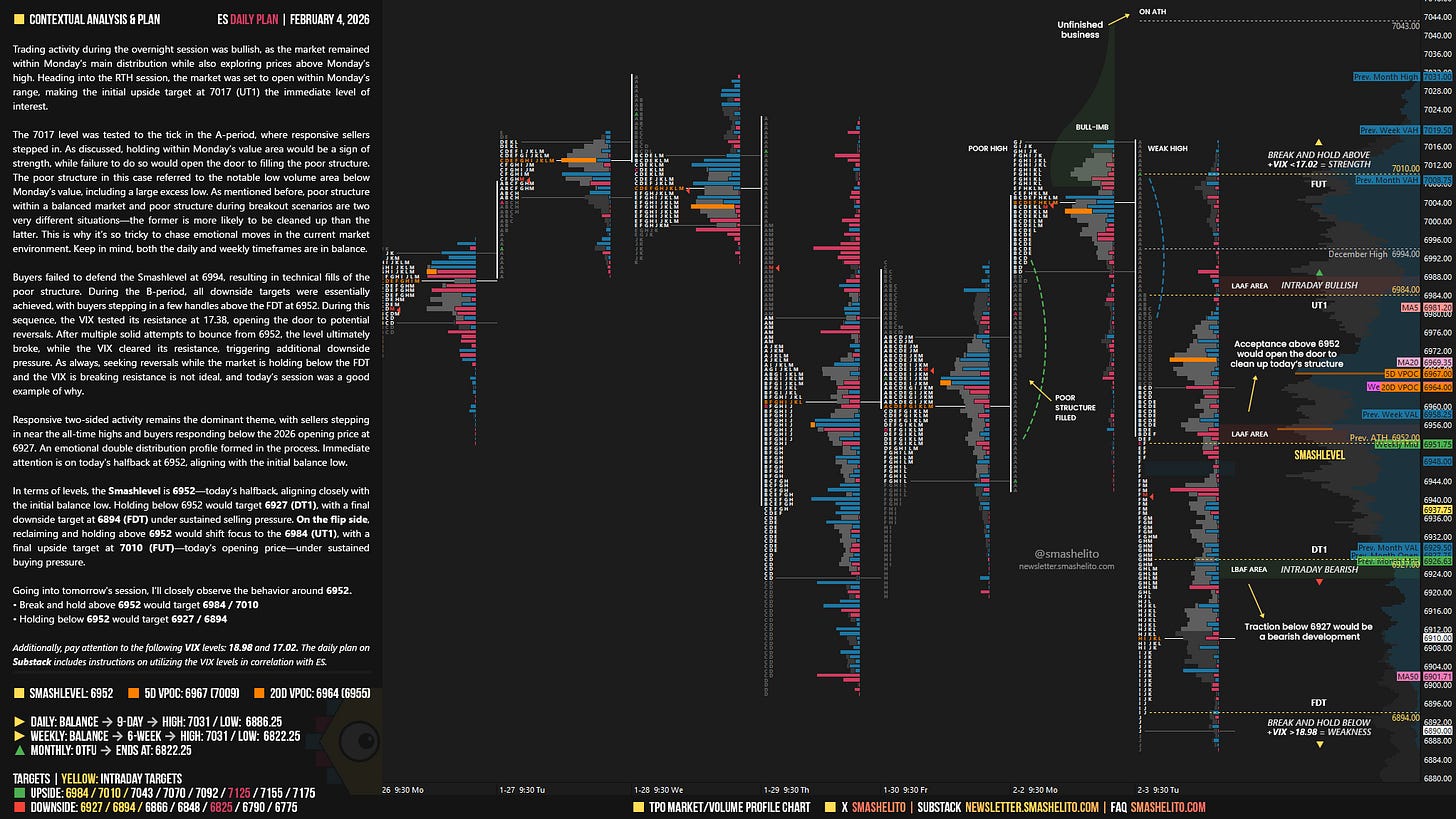

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Trading activity during the overnight session was bullish, as the market remained within Monday’s main distribution while also exploring prices above Monday’s high. Heading into the RTH session, the market was set to open within Monday’s range, making the initial upside target at 7017 (UT1) the immediate level of interest.

The 7017 level was tested to the tick in the A-period, where responsive sellers stepped in. As discussed, holding within Monday’s value area would be a sign of strength, while failure to do so would open the door to filling the poor structure. The poor structure in this case referred to the notable low volume area below Monday’s value, including a large excess low. As mentioned before, poor structure within a balanced market and poor structure during breakout scenarios are two very different situations—the former is more likely to be cleaned up than the latter. This is why it’s so tricky to chase emotional moves in the current market environment. Keep in mind, both the daily and weekly timeframes are in balance.

Buyers failed to defend the Smashlevel at 6994, resulting in technical fills of the poor structure. During the B-period, all downside targets were essentially achieved, with buyers stepping in a few handles above the FDT at 6952. During this sequence, the VIX tested its resistance at 17.38, opening the door to potential reversals. After multiple solid attempts to bounce from 6952, the level ultimately broke, while the VIX cleared its resistance, triggering additional downside pressure. As always, seeking reversals while the market is holding below the FDT and the VIX is breaking resistance is not ideal, and today’s session was a good example of why.

Responsive two-sided activity remains the dominant theme, with sellers stepping in near the all-time highs and buyers responding below the 2026 opening price at 6927. An emotional double distribution profile formed in the process. Immediate attention is on today’s halfback at 6952, aligning with the initial balance low.

In terms of levels, the Smashlevel is 6952—today’s halfback, aligning closely with the initial balance low. Holding below 6952 would target 6927 (DT1), with a final downside target at 6894 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6952 would shift focus to the 6984 (UT1), with a final upside target at 7010 (FUT)—today’s opening price—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6952.

Break and hold above 6952 would target 6984 / 7010

Holding below 6952 would target 6927 / 6894

Additionally, pay attention to the following VIX levels: 18.98 and 17.02. These levels can provide confirmation of strength or weakness.

Break and hold above 7010 with VIX below 17.02 would confirm strength.

Break and hold below 6894 with VIX above 18.98 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash!

I keep learning from you "poor structure within a balanced market and poor structure during breakout scenarios are two very different situations—the former is more likely to be cleaned up than the latter." Nothing better than having the question from the previous session answered with today's example. Thank you for taking the time to read the comments.