ES Daily Plan | February 3, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

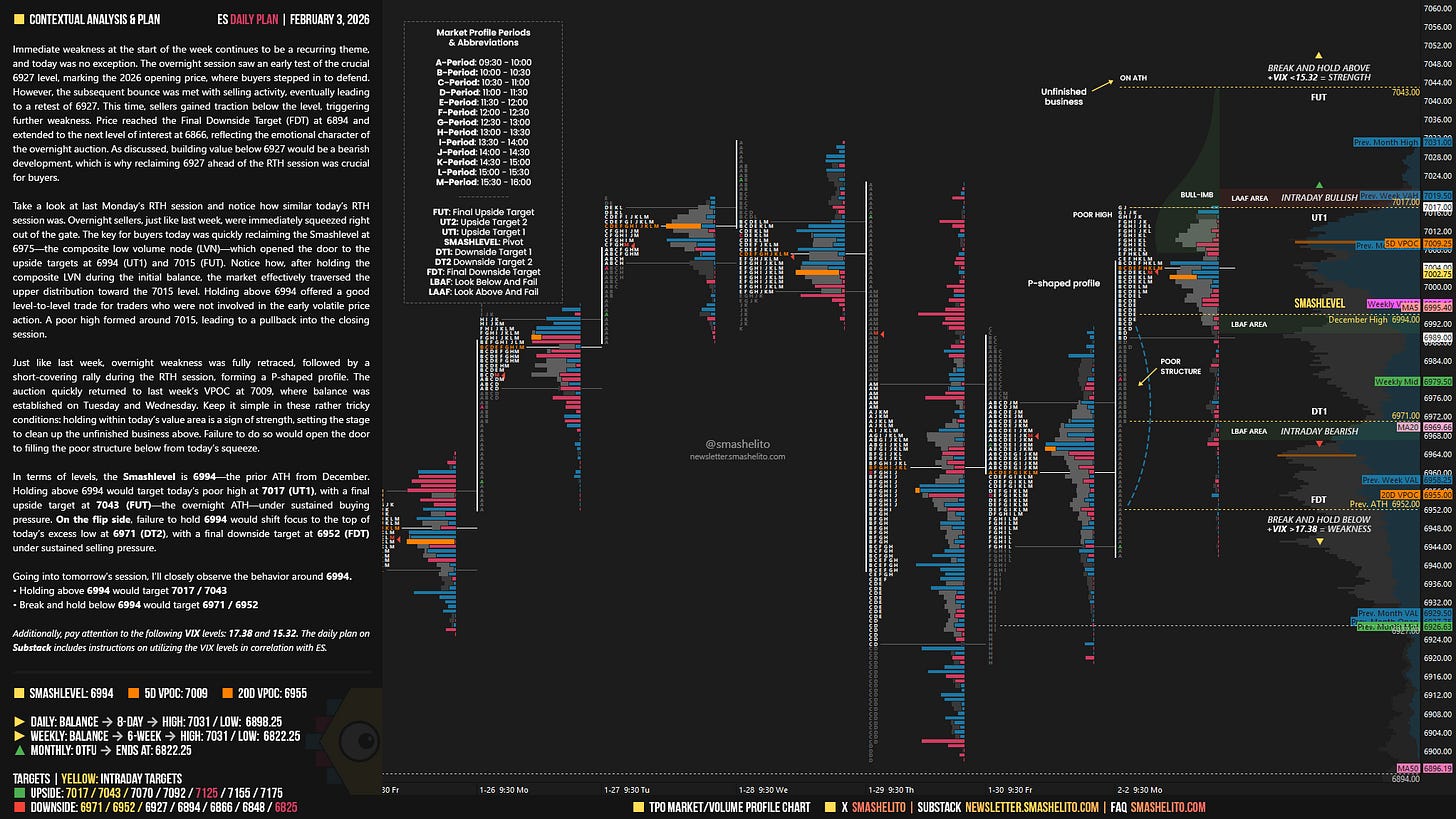

Immediate weakness at the start of the week continues to be a recurring theme, and today was no exception. The overnight session saw an early test of the crucial 6927 level, marking the 2026 opening price, where buyers stepped in to defend. However, the subsequent bounce was met with selling activity, eventually leading to a retest of 6927. This time, sellers gained traction below the level, triggering further weakness. Price reached the Final Downside Target (FDT) at 6894 and extended to the next level of interest at 6866, reflecting the emotional character of the overnight auction. As discussed, building value below 6927 would be a bearish development, which is why reclaiming 6927 ahead of the RTH session was crucial for buyers.

Take a look at last Monday’s RTH session and notice how similar today’s RTH session was. Overnight sellers, just like last week, were immediately squeezed right out of the gate. The key for buyers today was quickly reclaiming the Smashlevel at 6975—the composite low volume node (LVN)—which opened the door to the upside targets at 6994 (UT1) and 7015 (FUT). Notice how, after holding the composite LVN during the initial balance, the market effectively traversed the upper distribution toward the 7015 level. Holding above 6994 offered a good level-to-level trade for traders who were not involved in the early volatile price action. A poor high formed around 7015, leading to a pullback into the closing session.

Just like last week, overnight weakness was fully retraced, followed by a short-covering rally during the RTH session, forming a P-shaped profile. The auction quickly returned to last week’s VPOC at 7009, where balance was established on Tuesday and Wednesday. Keep it simple in these rather tricky conditions: holding within today’s value area is a sign of strength, setting the stage to clean up the unfinished business above. Failure to do so would open the door to filling the poor structure below from today’s squeeze.

In terms of levels, the Smashlevel is 6994—the prior ATH from December. Holding above 6994 would target today’s poor high at 7017 (UT1), with a final upside target at 7043 (FUT)—the overnight ATH—under sustained buying pressure.

On the flip side, failure to hold 6994 would shift focus to the top of today’s excess low at 6971 (DT2), with a final downside target at 6952 (FDT) under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6994.

Holding above 6994 would target 7017 / 7043

Break and hold below 6994 would target 6971 / 6952

Additionally, pay attention to the following VIX levels: 17.38 and 15.32. These levels can provide confirmation of strength or weakness.

Break and hold above 7043 with VIX below 15.32 would confirm strength.

Break and hold below 6952 with VIX above 17.38 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Smash, I don't understand how your model manages to be so precise. Thanks to MGI, we have a clear vision and approach to the market, but it's incredible how your levels and the VIX together tell the same story. Sometimes I worry that the day you stop or decide to do something else, I won't have this great help you provide. I'm preparing myself in case that happens, so I'm saving the newsletters on my PC to use as a basic guide if necessary.

Thank you as always Smash! FUT nailed the top!