ES Daily Plan | February 27, 2023

Friday’s session was balanced, with value migrating cleanly lower, but buyers were able to end the session within Thursday's range. Now the question is whether buyers can stay within Thursday's range.

Contextual Analysis

During Thursday's session, there was a rally, and it was uncertain whether the rally was solely driven by short-covering or if stronger buyers had entered the market. Friday's overnight (ON) session saw no new buying interest, resulting in a total reversal of Thursday's rally. Last week, there were highly emotional swings in both directions, and it's crucial to avoid chasing after these emotional moves. Thursday’s late buyers got smashed when the liquidation started during the European session on Friday.

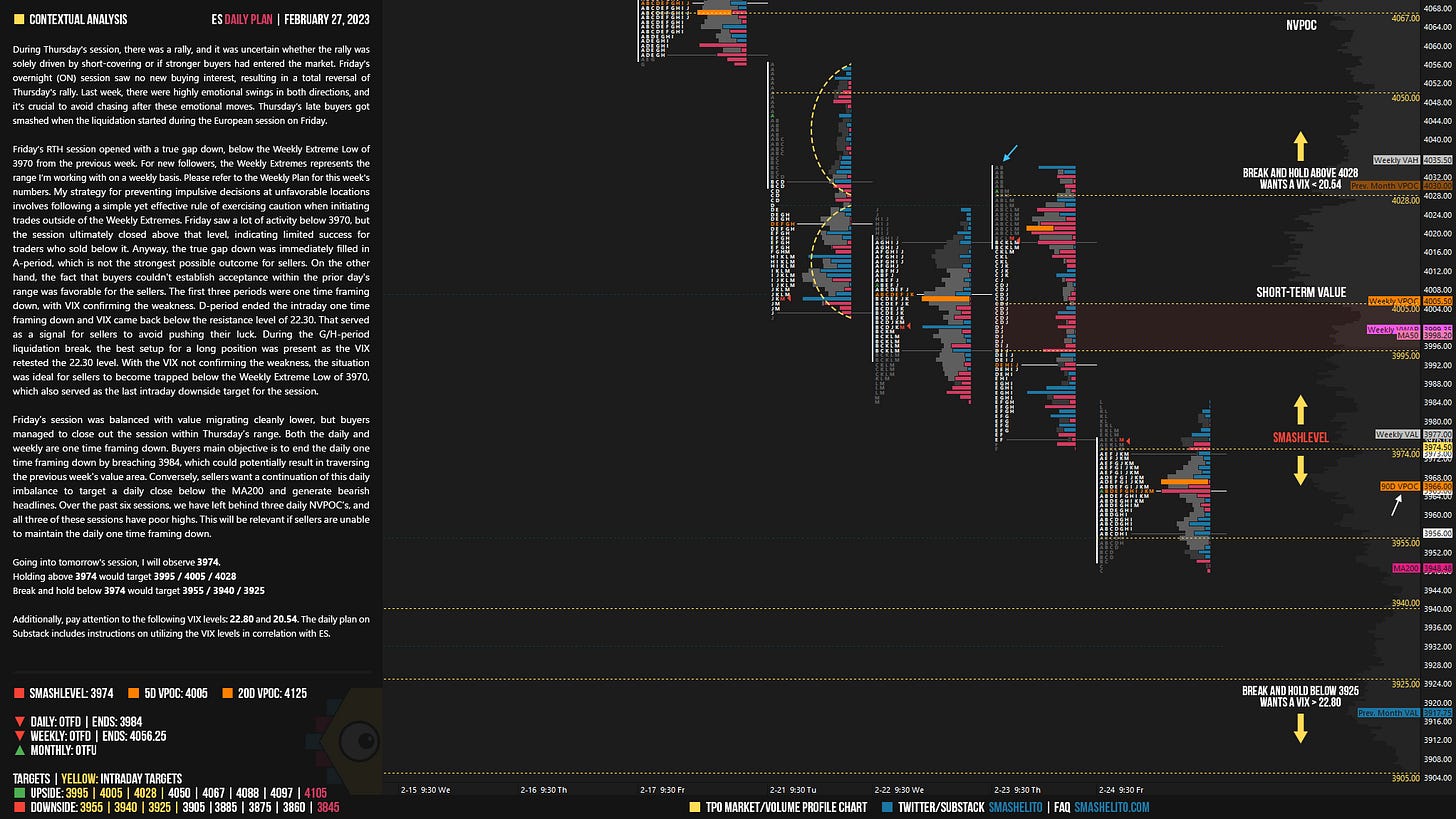

Friday’s RTH session opened with a true gap down, below the Weekly Extreme Low of 3970 from the previous week. For new followers, the Weekly Extremes represents the range I’m working with on a weekly basis. Please refer to the Weekly Plan for this week's numbers. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the Weekly Extremes. Friday saw a lot of activity below 3970, but the session ultimately closed above that level, indicating limited success for traders who sold below it. Anyway, the true gap down was immediately filled in A-period, which is not the strongest possible outcome for sellers. On the other hand, the fact that buyers couldn't establish acceptance within the prior day's range was favorable for the sellers. The first three periods were one time framing down, with VIX confirming the weakness. D-period ended the intraday one time framing down and VIX came back below the resistance level of 22.30. That served as a signal for sellers to avoid pushing their luck. During the G/H-period liquidation break, the best setup for a long position was present as the VIX retested the 22.30 level. With the VIX not confirming the weakness, the situation was ideal for sellers to become trapped below the Weekly Extreme Low of 3970, which also served as the last intraday downside target for the session.

Friday’s session was balanced with value migrating cleanly lower, but buyers managed to close out the session within Thursday’s range. Both the daily and weekly are one time framing down. Buyers main objective is to end the daily one time framing down by breaching 3984, which could potentially result in traversing the previous week's value area. Conversely, sellers want a continuation of this daily imbalance to target a daily close below the MA200 and generate bearish headlines. Over the past six sessions, we have left behind three daily NVPOC’s, and all three of these sessions have poor highs. This will be relevant if sellers are unable to maintain the daily one time framing down.

Going into tomorrow's session, I will observe 3974.

Holding above 3974 would target 3995 / 4005 / 4028

Break and hold below 3974 would target 3955 / 3940 / 3925

Additionally, pay attention to the following VIX levels: 22.80 and 20.54. These levels can provide confirmation of strength or weakness.

Break and hold above 4028 with VIX below 20.54 would confirm strength.

Break and hold below 3925 with VIX above 22.80 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

With the data we are seeing, there is little to be bullish, but they may keep market up for most of this week for the monthly flows. Sellers beware