ES Daily Plan | February 2, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

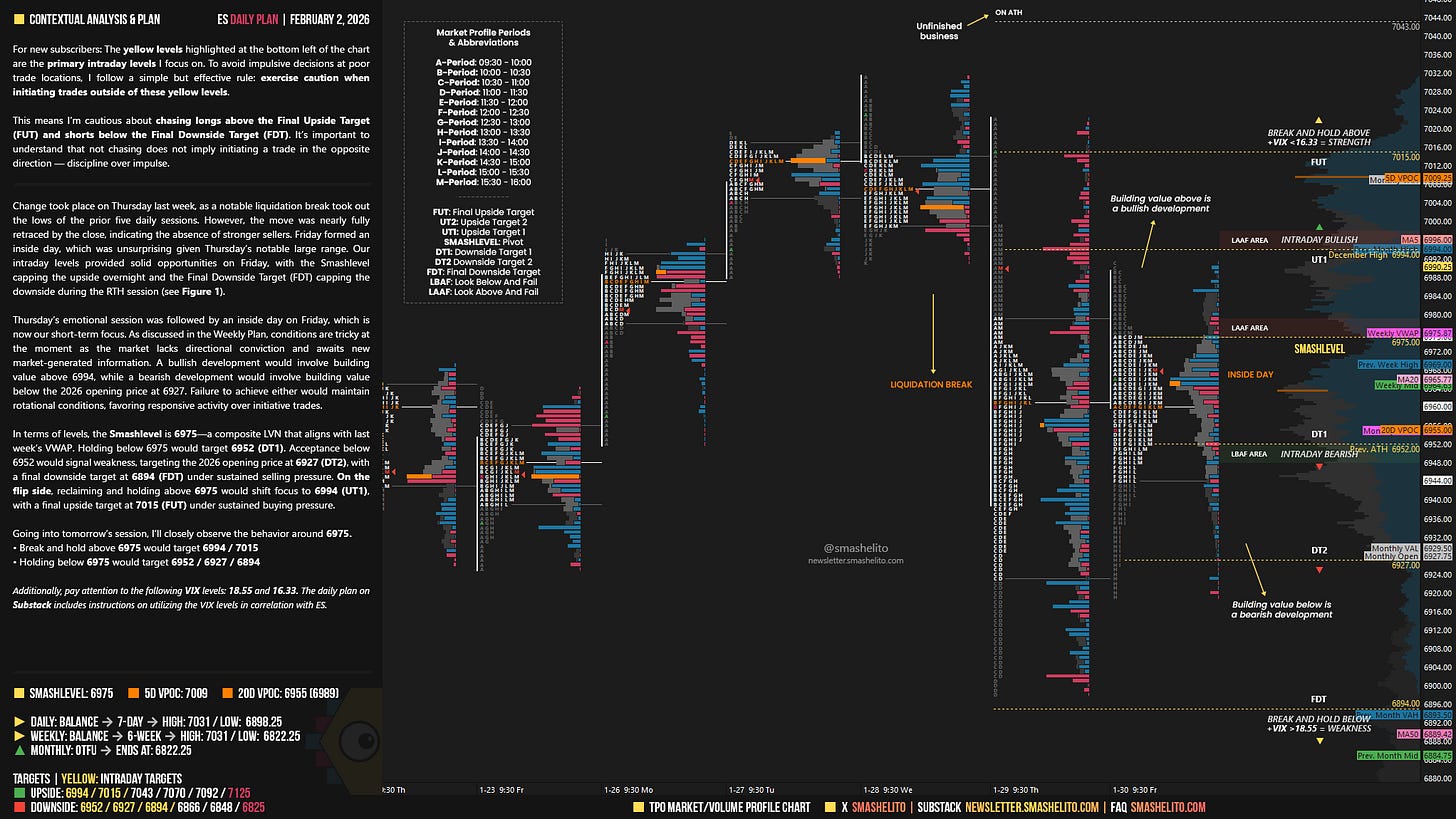

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

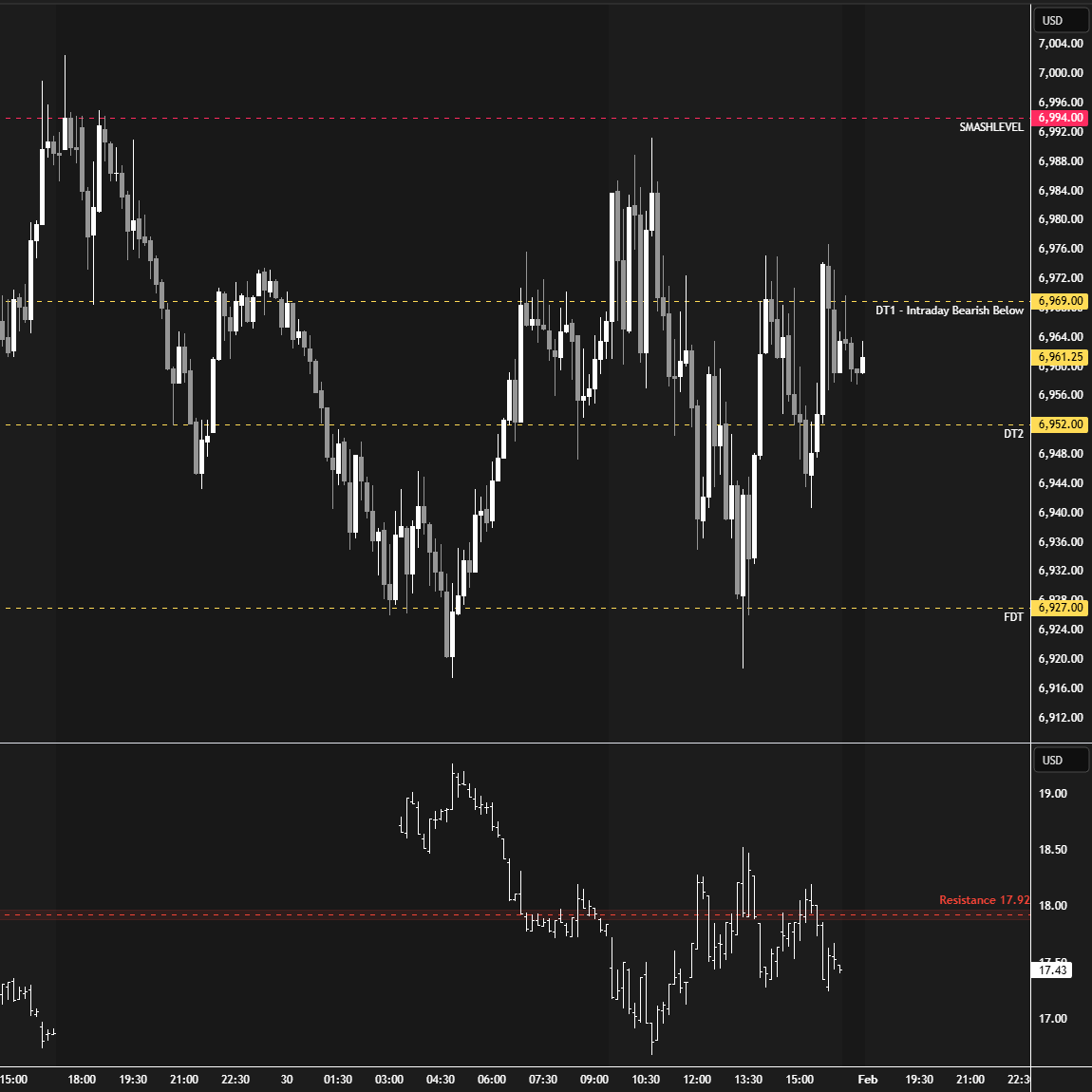

Change took place on Thursday last week, as a notable liquidation break took out the lows of the prior five daily sessions. However, the move was nearly fully retraced by the close, indicating the absence of stronger sellers. Friday formed an inside day, which was unsurprising given Thursday’s notable large range. Our intraday levels provided solid opportunities on Friday, with the Smashlevel capping the upside overnight and the Final Downside Target (FDT) capping the downside during the RTH session (see Figure 1).

Thursday’s emotional session was followed by an inside day on Friday, which is now our short-term focus. As discussed in the Weekly Plan, conditions are tricky at the moment as the market lacks directional conviction and awaits new market-generated information.

A bullish development would involve building value above 6994, while a bearish development would involve building value below the 2026 opening price at 6927. Failure to achieve either would maintain rotational conditions, favoring responsive activity over initiative trades.

In terms of levels, the Smashlevel is 6975—a composite LVN that aligns with last week’s VWAP. Holding below 6975 would target 6952 (DT1). Acceptance below 6952 would signal weakness, targeting the 2026 opening price at 6927 (DT2), with a final downside target at 6894 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6975 would shift focus to 6994 (UT1), with a final upside target at 7015 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6975.

Break and hold above 6975 would target 6994 / 7015

Holding below 6975 would target 6952 / 6927 / 6894

Additionally, pay attention to the following VIX levels: 18.55 and 16.33. These levels can provide confirmation of strength or weakness.

Break and hold above 7015 with VIX below 16.33 would confirm strength.

Break and hold below 6894 with VIX above 18.55 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

The 6975 pivot being a composite LVN aligned with last week's VWAP is a strong setup - those confluences usually deliver cleaner reactions. I've noticed when Friday forms an inside day after big liquidiation moves like Thursday's, the breakout direction on Monday tends to follow whichever way pre-market volume leans. VIX confirmation at 16.33/18.55 is solid too, helps filter false breaks.

Thanks Smash! Let's see where we open.