ES Daily Plan | February 17, 2023

The previous week was identified as an "inside week," and presently, the current week is also displaying this pattern, suggesting that the market is still waiting for more MGI.

Contextual Analysis

NOTE: I'm away from the desk for the next few days, so the daily plans will be provided in a condensed, commentary-free format. Regular, detailed plans will resume on Wednesday, February 22nd.

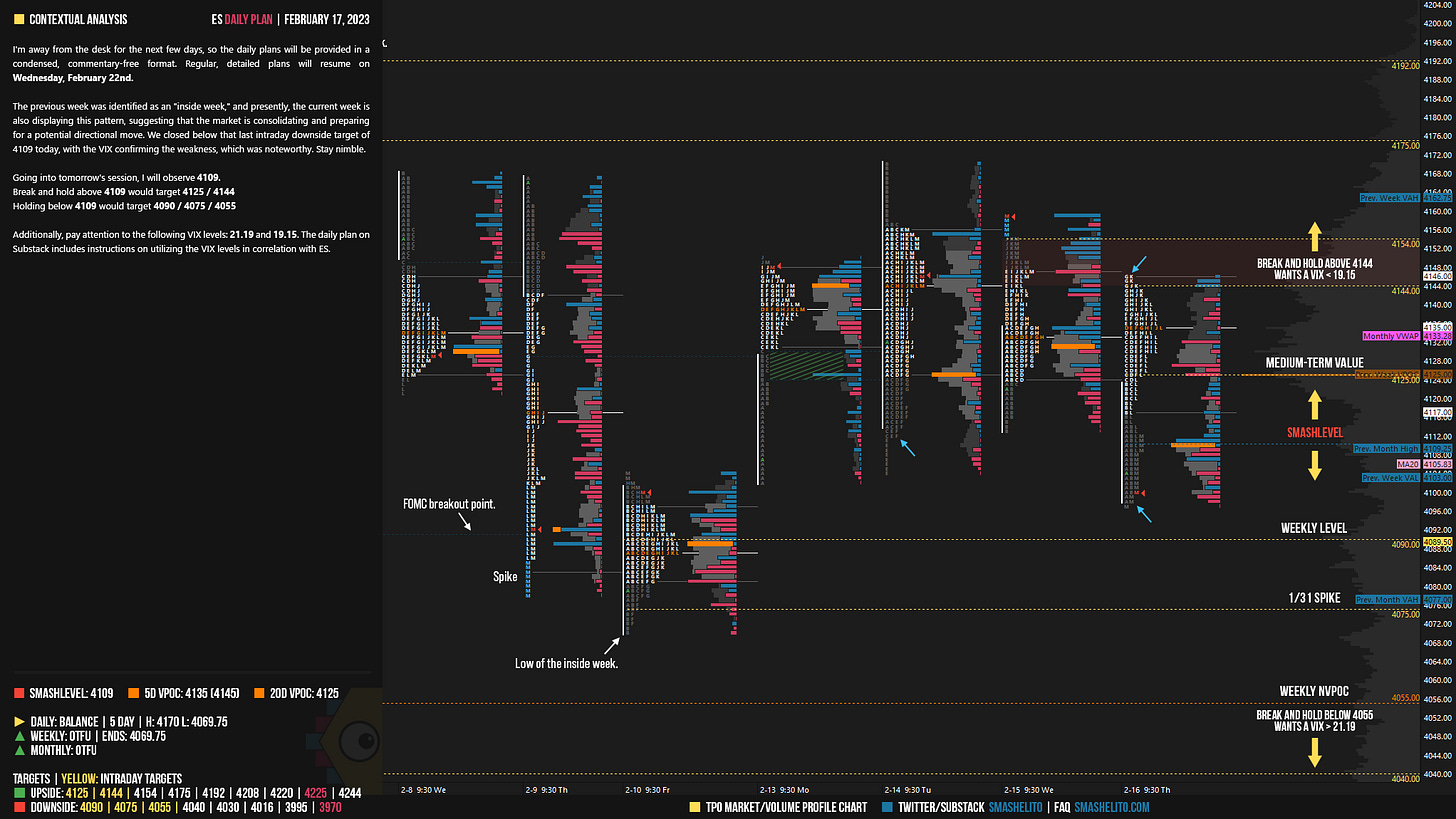

The previous week was identified as an "inside week," and presently, the current week is also displaying this pattern, suggesting that the market is consolidating and preparing for a potential directional move. We closed below that last intraday downside target of 4109 today, with the VIX confirming the weakness, which was noteworthy. Stay nimble.

Going into tomorrow's session, I will observe 4109.

Holding above 4109 would target 4125 / 4144

Break and hold below 4109 would target 4090 / 4075 / 4055

Additionally, pay attention to the following VIX levels: 21.19 and 19.15. These levels can provide confirmation of strength or weakness.

Break and hold above 4144 with VIX below 19.15 would confirm strength.

Break and hold below 4055 with VIX above 21.19 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Thank you for your selfless sharing, good work!

Thank you, Smash, for providing this despite your absence!