ES Daily Plan | February 16/17, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

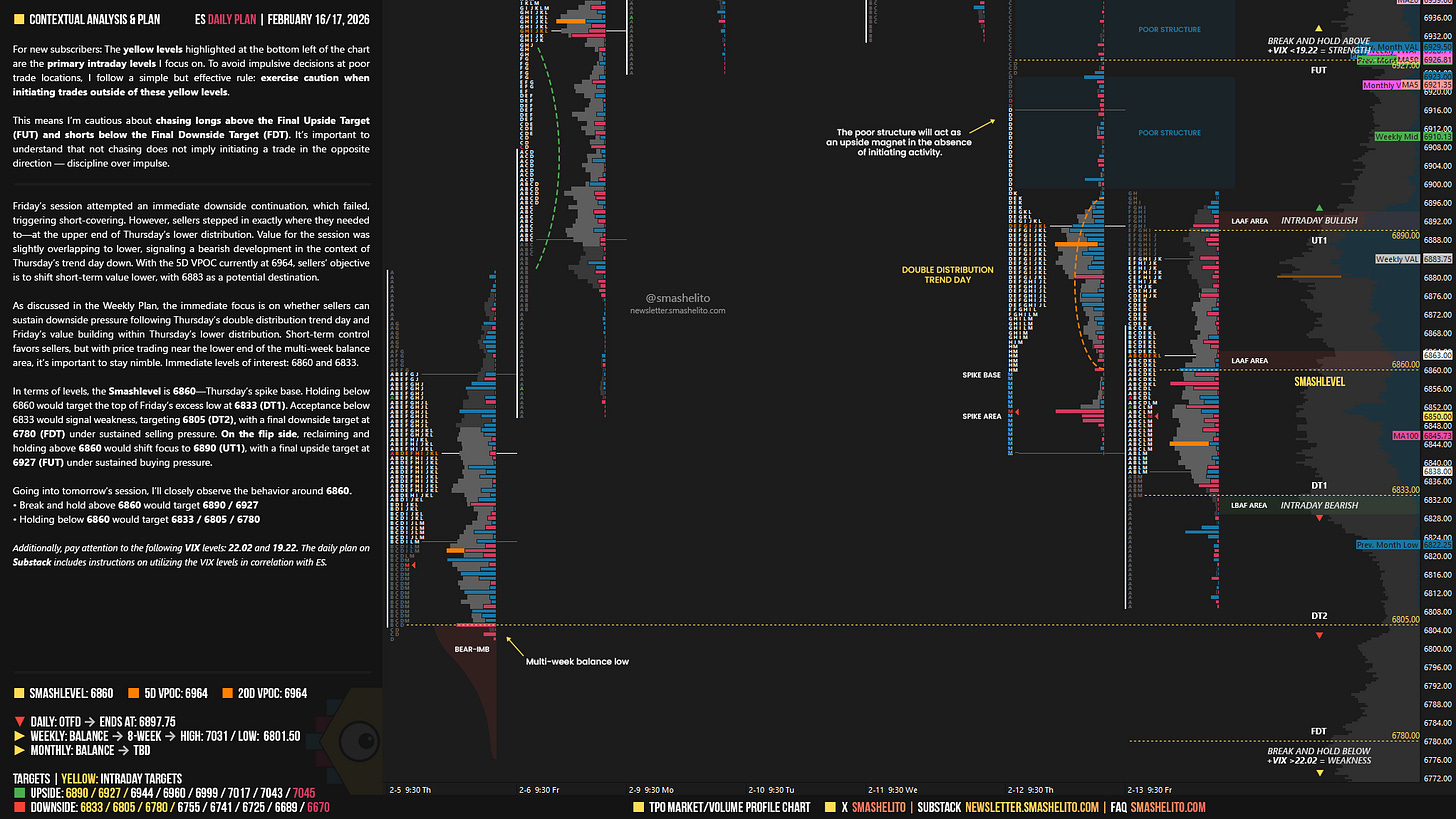

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Friday’s session attempted an immediate downside continuation, which failed, triggering short-covering. However, sellers stepped in exactly where they needed to—at the upper end of Thursday’s lower distribution. Value for the session was slightly overlapping to lower, signaling a bearish development in the context of Thursday’s trend day down. With the 5D VPOC currently at 6964, sellers’ objective is to shift short-term value lower, with 6883 as a potential destination.

As discussed in the Weekly Plan, the immediate focus is on whether sellers can sustain downside pressure following Thursday’s double distribution trend day and Friday’s value building within Thursday’s lower distribution. Short-term control favors sellers, but with price trading near the lower end of the multi-week balance area, it’s important to stay nimble. Immediate levels of interest: 6860 and 6833.

In terms of levels, the Smashlevel is 6860—Thursday’s spike base. Holding below 6860 would target the top of Friday’s excess low at 6833 (DT1). Acceptance below 6833 would signal weakness, targeting 6805 (DT2), with a final downside target at 6780 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6860 would shift focus to 6890 (UT1), with a final upside target at 6927 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6860.

Break and hold above 6860 would target 6890 / 6927

Holding below 6860 would target 6833 / 6805 / 6780

Additionally, pay attention to the following VIX levels: 22.02 and 19.22. These levels can provide confirmation of strength or weakness.

Break and hold above 6927 with VIX below 19.22 would confirm strength.

Break and hold below 6780 with VIX above 22.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

What does the smashlevel entail? Is that the price from which I should execute a trade, or is it more of a border in regards to going long (if price holds above 6890) or going short (if price holds below 6890). In other words, since it's holding above 6890, we should target 6890 / 6927 right?

Hey smash UT1 6890? On chart it’s 6890 and in the level of interest 6897. I assume 6890. Thanks