ES Daily Plan | February 16, 2024

Buyers now have a chance at an outside week up, following the look below and fail on Tuesday, making the previous week’s high at 5048.50 a level of interest in the short-term.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

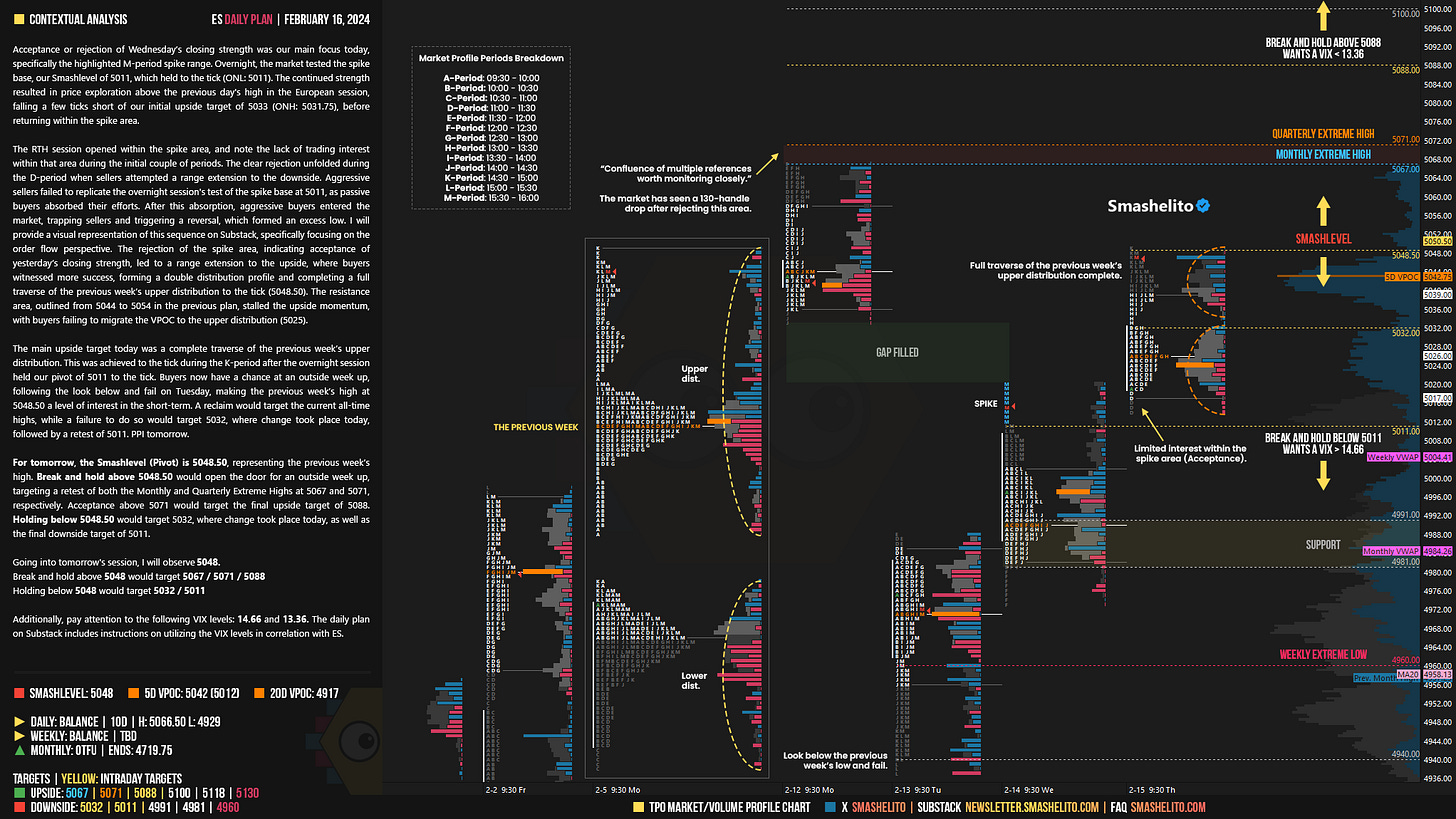

Acceptance or rejection of Wednesday’s closing strength was our main focus today, specifically the highlighted M-period spike range. Overnight, the market tested the spike base, our Smashlevel of 5011, which held to the tick (ONL: 5011). The continued strength resulted in price exploration above the previous day's high in the European session, falling a few ticks short of our initial upside target of 5033 (ONH: 5031.75), before returning within the spike area.

The RTH session opened within the spike area, and note the lack of trading interest within that area during the initial couple of periods. The clear rejection unfolded during the D-period when sellers attempted a range extension to the downside. Aggressive sellers failed to replicate the overnight session's test of the spike base at 5011, as passive buyers absorbed their efforts. After this absorption, aggressive buyers entered the market, trapping sellers and triggering a reversal, which formed an excess low. I will provide a visual representation of this sequence on Substack, specifically focusing on the order flow perspective. The rejection of the spike area, indicating acceptance of yesterday’s closing strength, led to a range extension to the upside, where buyers witnessed more success, forming a double distribution profile and completing a full traverse of the previous week’s upper distribution to the tick (5048.50). The resistance area, outlined from 5044 to 5054 in the previous plan, stalled the upside momentum, with buyers failing to migrate the VPOC to the upper distribution (5025).

The main upside target today was a complete traverse of the previous week’s upper distribution. This was achieved to the tick during the K-period after the overnight session held our pivot of 5011 to the tick. Buyers now have a chance at an outside week up, following the look below and fail on Tuesday, making the previous week’s high at 5048.50 a level of interest in the short-term. A reclaim would target the current all-time highs, while a failure to do so would target 5032, where change took place today, followed by a retest of 5011. PPI tomorrow.

For tomorrow, the Smashlevel (Pivot) is 5048.50, representing the previous week’s high. Break and hold above 5048.50 would open the door for an outside week up, targeting a retest of both the Monthly and Quarterly Extreme Highs at 5067 and 5071, respectively. Acceptance above 5071 would target the final upside target of 5088. Holding below 5048.50 would target 5032, where change took place today, as well as the final downside target of 5011.

Levels of Interest

Going into tomorrow's session, I will observe 5048.

Break and hold above 5048 would target 5067 / 5071 / 5088

Holding below 5048 would target 5032 / 5011

Additionally, pay attention to the following VIX levels: 14.66 and 13.36. These levels can provide confirmation of strength or weakness.

Break and hold above 5088 with VIX below 13.36 would confirm strength.

Break and hold below 5011 with VIX above 14.66 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Let's finish this week strong 💪

Thanks! Love these additional visuals!