ES Daily Plan | December 31, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

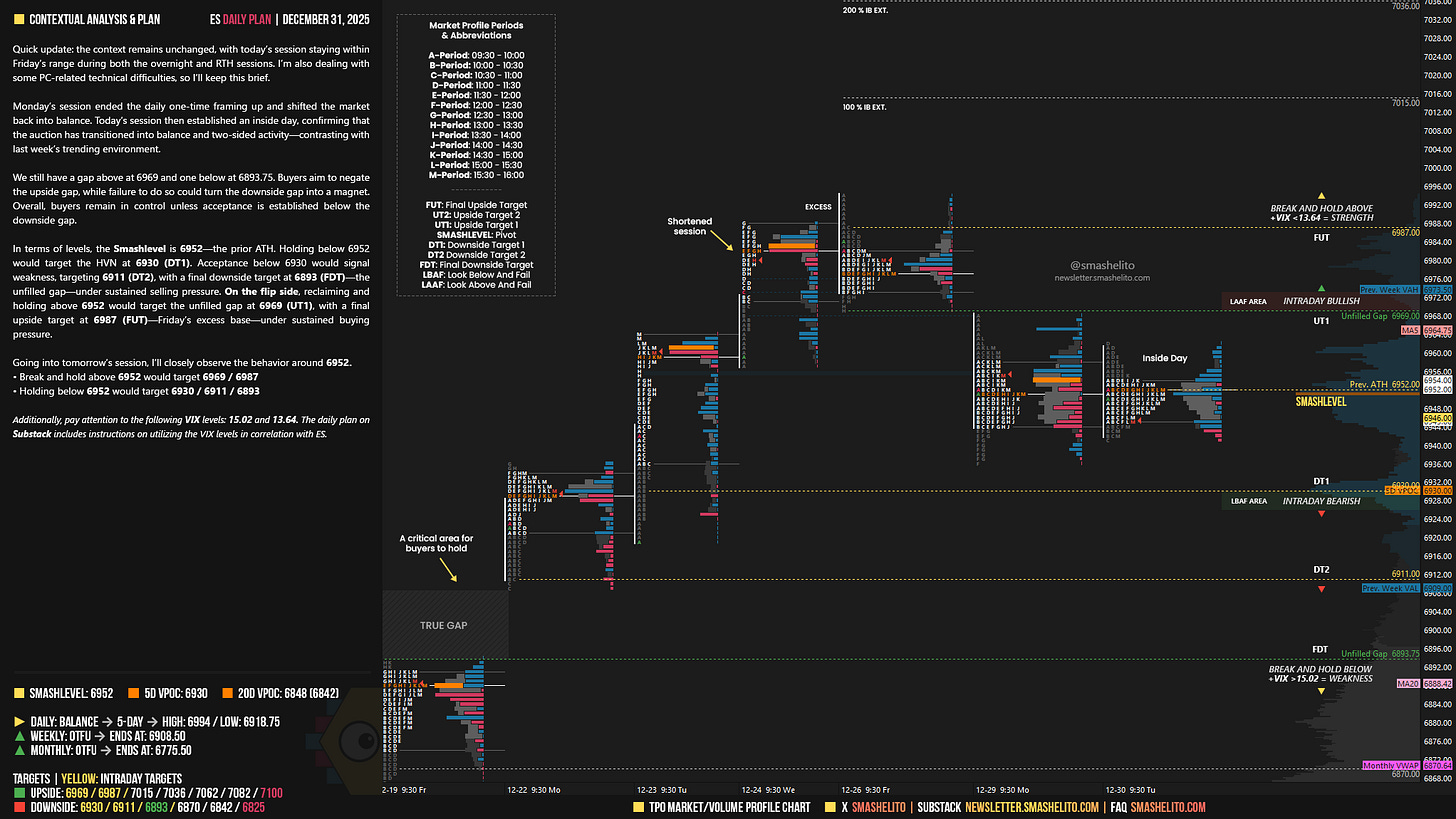

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Quick update: the context remains unchanged, with today’s session staying within Friday’s range during both the overnight and RTH sessions. I’m also dealing with some PC-related technical difficulties, so I’ll keep this brief.

Monday’s session ended the daily one-time framing up and shifted the market back into balance. Today’s session then established an inside day, confirming that the auction has transitioned into balance and two-sided activity—contrasting with last week’s trending environment.

We still have a gap above at 6969 and one below at 6893.75. Buyers aim to negate the upside gap, while failure to do so could turn the downside gap into a magnet. Overall, buyers remain in control unless acceptance is established below the downside gap.

In terms of levels, the Smashlevel is 6952—the prior ATH. Holding below 6952 would target the HVN at 6930 (DT1). Acceptance below 6930 would signal weakness, targeting 6911 (DT2), with a final downside target at 6893 (FDT)—the unfilled gap—under sustained selling pressure.

On the flip side, reclaiming and holding above 6952 would target the unfilled gap at 6969 (UT1), with a final upside target at 6987 (FUT)—Friday’s excess base—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6952.

Break and hold above 6952 would target 6969 / 6987

Holding below 6952 would target 6930 / 6911 / 6893

Additionally, pay attention to the following VIX levels: 15.02 and 13.64. These levels can provide confirmation of strength or weakness.

Break and hold above 6987 with VIX below 13.64 would confirm strength.

Break and hold below 6893 with VIX above 15.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

So as of right now we've shown a lack of responsive buying. Open-reject-reverse type that auctioned straight through the HVN. Price testing the buying tail from last Tuesday. So we need some responsive buying at this level or that lower gap is probably on the table, right?

I thank you for doing this daily.