ES Daily Plan | December 23, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

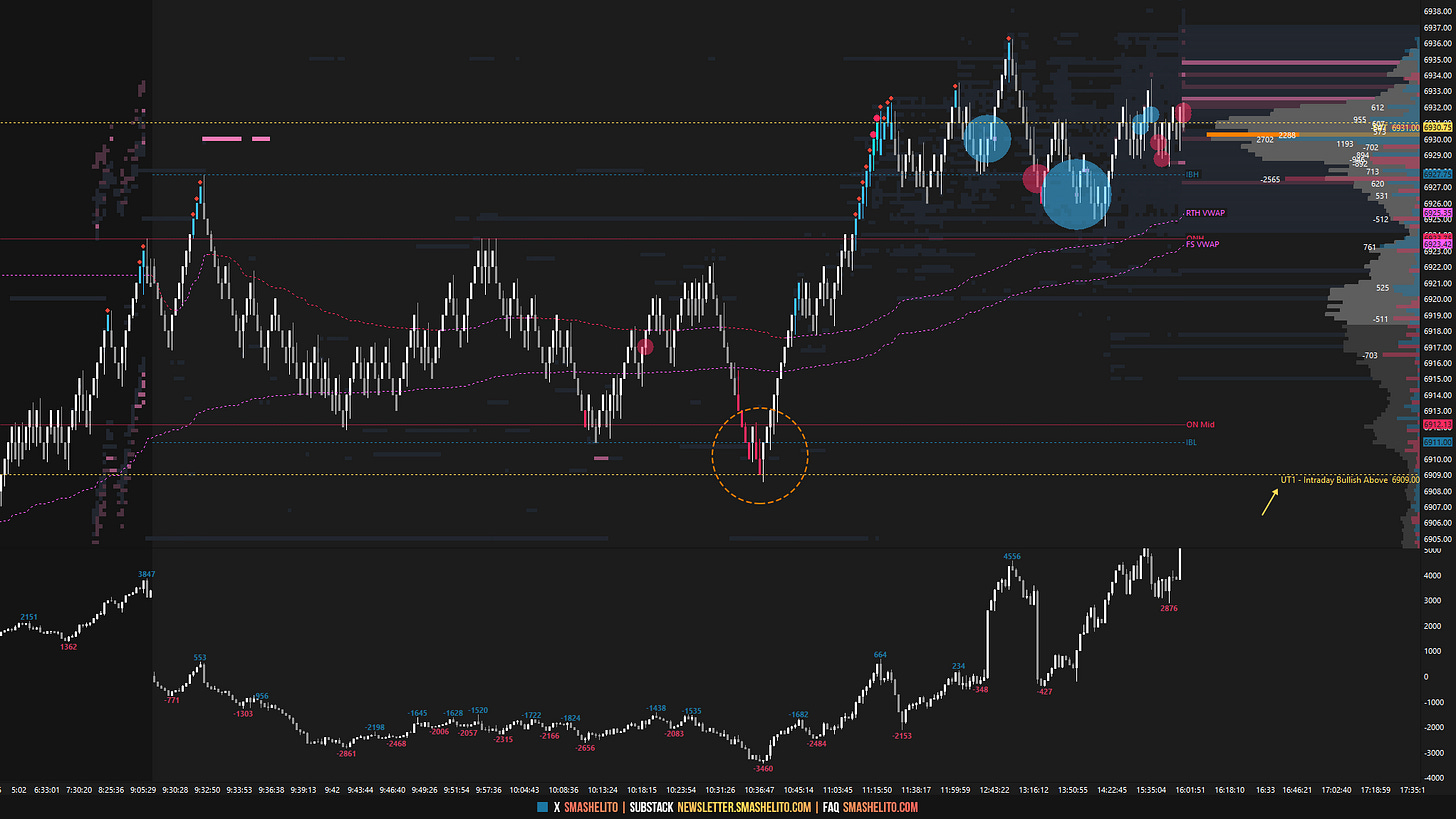

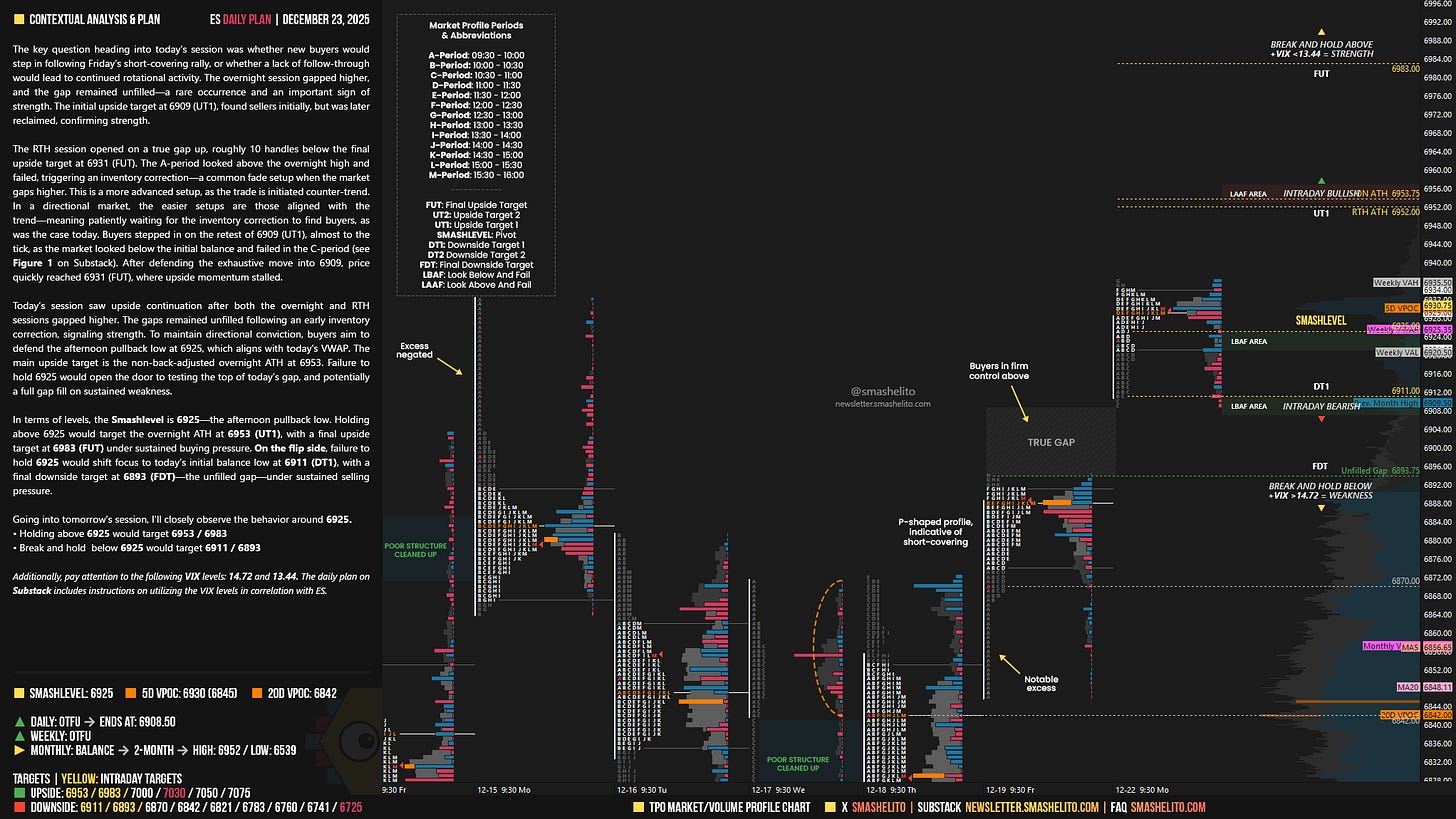

The key question heading into today’s session was whether new buyers would step in following Friday’s short-covering rally, or whether a lack of follow-through would lead to continued rotational activity. The overnight session gapped higher, and the gap remained unfilled—a rare occurrence and an important sign of strength. The initial upside target at 6909 (UT1), found sellers initially, but was later reclaimed, confirming strength.

The RTH session opened on a true gap up, roughly 10 handles below the final upside target at 6931 (FUT). The A-period looked above the overnight high and failed, triggering an inventory correction—a common fade setup when the market gaps higher. This is a more advanced setup, as the trade is initiated counter-trend. In a directional market, the easier setups are those aligned with the trend—meaning patiently waiting for the inventory correction to find buyers, as was the case today. Buyers stepped in on the retest of 6909 (UT1), almost to the tick, as the market looked below the initial balance and failed in the C-period (see Figure 1). After defending the exhaustive move into 6909, price quickly reached 6931 (FUT), where upside momentum stalled.

Today’s session saw upside continuation after both the overnight and RTH sessions gapped higher. The gaps remained unfilled following an early inventory correction, signaling strength. To maintain directional conviction, buyers aim to defend the afternoon pullback low at 6925, which aligns with today’s VWAP. The main upside target is the non-back-adjusted overnight ATH at 6953. Failure to hold 6925 would open the door to testing the top of today’s gap, and potentially a full gap fill on sustained weakness.

In terms of levels, the Smashlevel is 6925—the afternoon pullback low. Holding above 6925 would target the overnight ATH at 6953 (UT1), with a final upside target at 6983 (FUT) under sustained buying pressure.

On the flip side, failure to hold 6925 would shift focus to today’s initial balance low at 6911 (DT1), with a final downside target at 6893 (FDT)—the unfilled gap—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6925.

Holding above 6925 would target 6953 / 6983

Break and hold below 6925 would target 6911 / 6893

Additionally, pay attention to the following VIX levels: 14.72 and 13.44. These levels can provide confirmation of strength or weakness.

Break and hold above 6983 with VIX below 13.44 would confirm strength.

Break and hold below 6893 with VIX above 14.72 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

This is amazingly concise content. Thank you.

Thanks!