ES Daily Plan | December 22, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

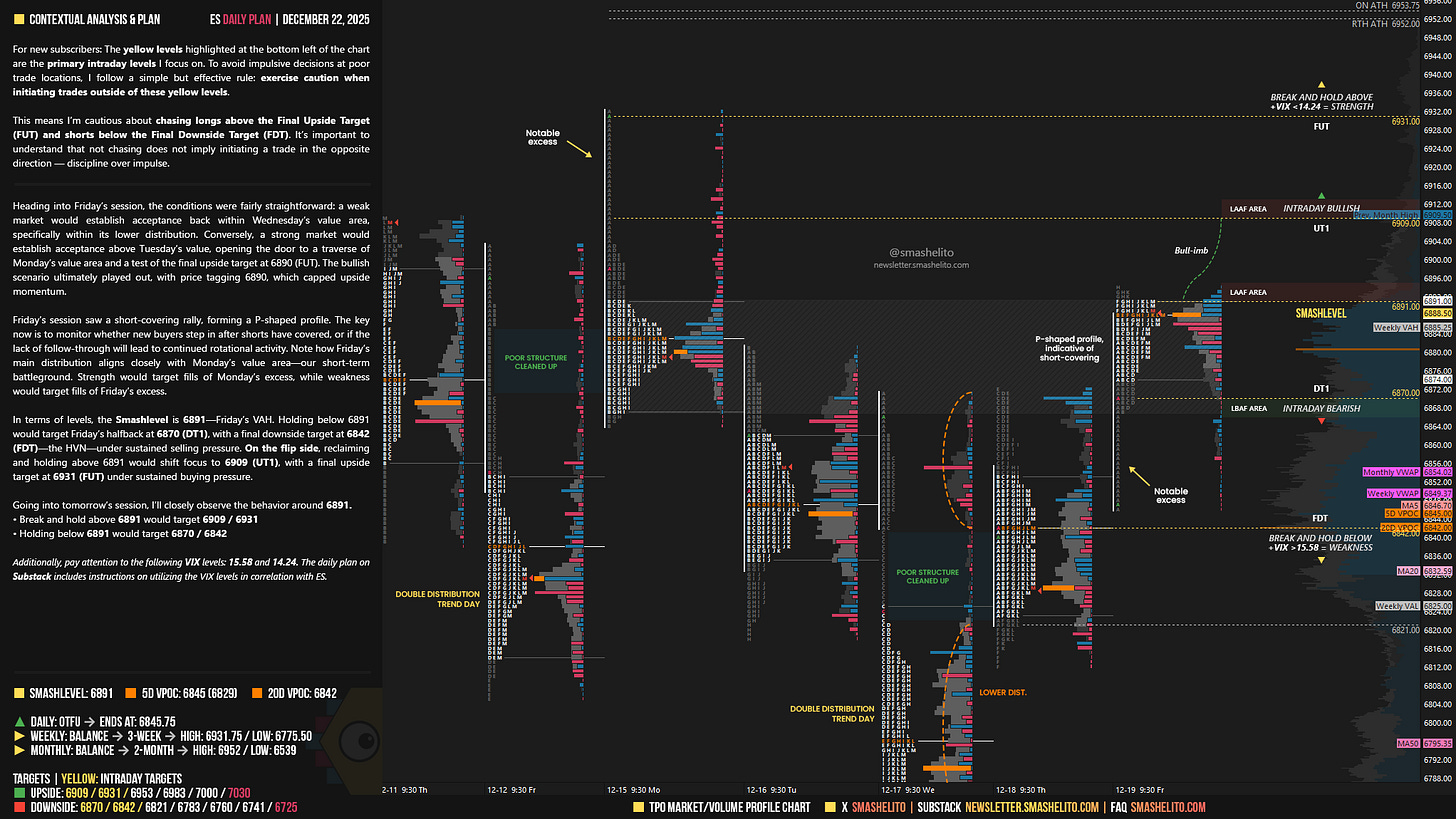

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Heading into Friday’s session, the conditions were fairly straightforward: a weak market would establish acceptance back within Wednesday’s value area, specifically within its lower distribution. Conversely, a strong market would establish acceptance above Tuesday’s value, opening the door to a traverse of Monday’s value area and a test of the final upside target at 6890 (FUT). The bullish scenario ultimately played out, with price tagging 6890, which capped upside momentum.

Friday’s session saw a short-covering rally, forming a P-shaped profile. The key now is to monitor whether new buyers step in after shorts have covered, or if the lack of follow-through will lead to continued rotational activity. Note how Friday’s main distribution aligns closely with Monday’s value area—our short-term battleground. Strength would target fills of Monday’s excess, while weakness would target fills of Friday’s excess.

In terms of levels, the Smashlevel is 6891—Friday’s VAH. Holding below 6891 would target Friday’s halfback at 6870 (DT1), with a final downside target at 6842 (FDT)—the HVN—under sustained selling pressure.

On the flip side, reclaiming and holding above 6891 would shift focus to 6909 (UT1), with a final upside target at 6931 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6891.

Break and hold above 6891 would target 6909 / 6931

Holding below 6891 would target 6870 / 6842

Additionally, pay attention to the following VIX levels: 15.58 and 14.24. These levels can provide confirmation of strength or weakness.

Break and hold above 6931 with VIX below 14.24 would confirm strength.

Break and hold below 6842 with VIX above 15.58 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks, Smash! I've been away for a while and getting reoriented to your process.

Merry Christmas!

Long time reader. Appreciate your insight always. Thanks for all your efforts to inform.