ES Daily Plan | August 8, 2023

The majority of Friday's poor structure cleaned up today, due to the absence of initiative sellers.

The daily remains in a state of balance, highlighting the importance of staying nimble.

Contextual Analysis

In the previous daily plan, we discussed that the low of both the weekly and daily balance area might not be the most ideal location for shorting contextually, unless there is a clear establishment of value below 4498. During the overnight (ON) session, there was no trading interest below 4498 (ON low: 4500.50). As a result, the market began to clean up the poor structure left from Friday's emotional session. The first upside target of 4520 was reached during the European session, triggering some selling activity.

During the initial phase of the RTH session, trading occurred in and out of Friday's value area, as the market continued to address the structural deficiencies from Friday’s profile. Following its break above the initial balance high, the C-period presented a solid setup, considering the choppy price action. Aggressive sellers were quick to enter, leading to a 15 handle drop. I will provide a visual of this sequence for reference on Substack.

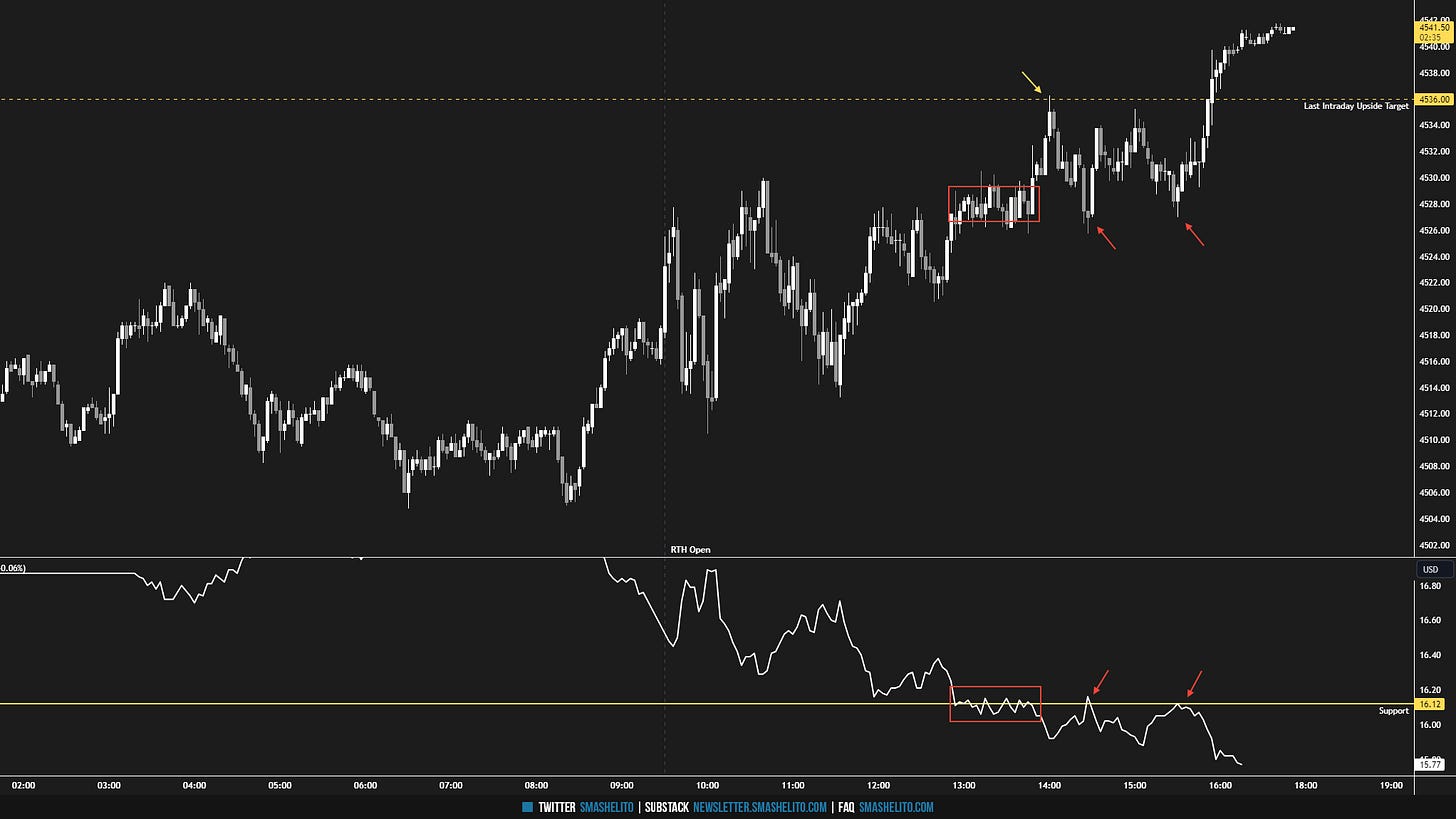

The H-period held notable interest, staying within a 4-handle range. Meanwhile, the VIX started a gradual breach of its support level at 16.12, indicating the possibility of a potential pop higher towards the last upside target of 4536 was in play. The 4536 level was reached almost to the tick in J-period (4536.25), prompting a round of selling activity. Did you notice how the pullbacks from 4536 found buying activity as the VIX retested its broken 16.12 support level from below? I will provide a visual of this as well.

Today’s session resulted in an inside day, with an upward spike following the M-period's establishment of a new daily high. By analyzing the profile, it is evident that the market successfully cleaned up the majority of Friday's poor structure, emphasizing the importance of navigating the market day by day, to avoid emotional decisions. Did today's price action solely involve technical fills of structure, or have sellers encountered difficulties once more? While not much activity favored sellers today, it's worth noting that the short-term value (5-day VPOC) has shifted downward from 4604 to 4525. The base of the spike at 4536 will serve as my short-term level of interest. Buyers are targeting the upper end of the multi-day balance area, while sellers are aiming for the lower end, should they manage to negate today's closing move.

For tomorrow, the Smashlevel (Pivot) is 4536, representing today’s base of the M-period spike. Holding above 4536 would target 4553.75, as well as the last upside target of 4570, representing the 4DB high. Break and hold below 4536 would target today’s afternoon pullback low at 4520, as well as the last downside target of 4498, representing the lower end of the 4DB.

Going into tomorrow's session, I will observe 4536.

Holding above 4536 would target 4553 / 4570

Break and hold below 4536 would target 4520 / 4498

Additionally, pay attention to the following VIX levels: 16.68 and 14.86. These levels can provide confirmation of strength or weakness.

Break and hold above 4570 with VIX below 14.86 would confirm strength.

Break and hold below 4498 with VIX above 16.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

It looks like during earnings season sellers are not pushing too hard and taking their time, given where AAPL is heading

Great plan and analysis. Thank you