ES Daily Plan | August 14, 2023

The lack of initiative sellers on Friday ultimately resulted in two-sided activity. I will continue using the 4487/4493 area to assess the short-term strength or weakness.

Contextual Analysis

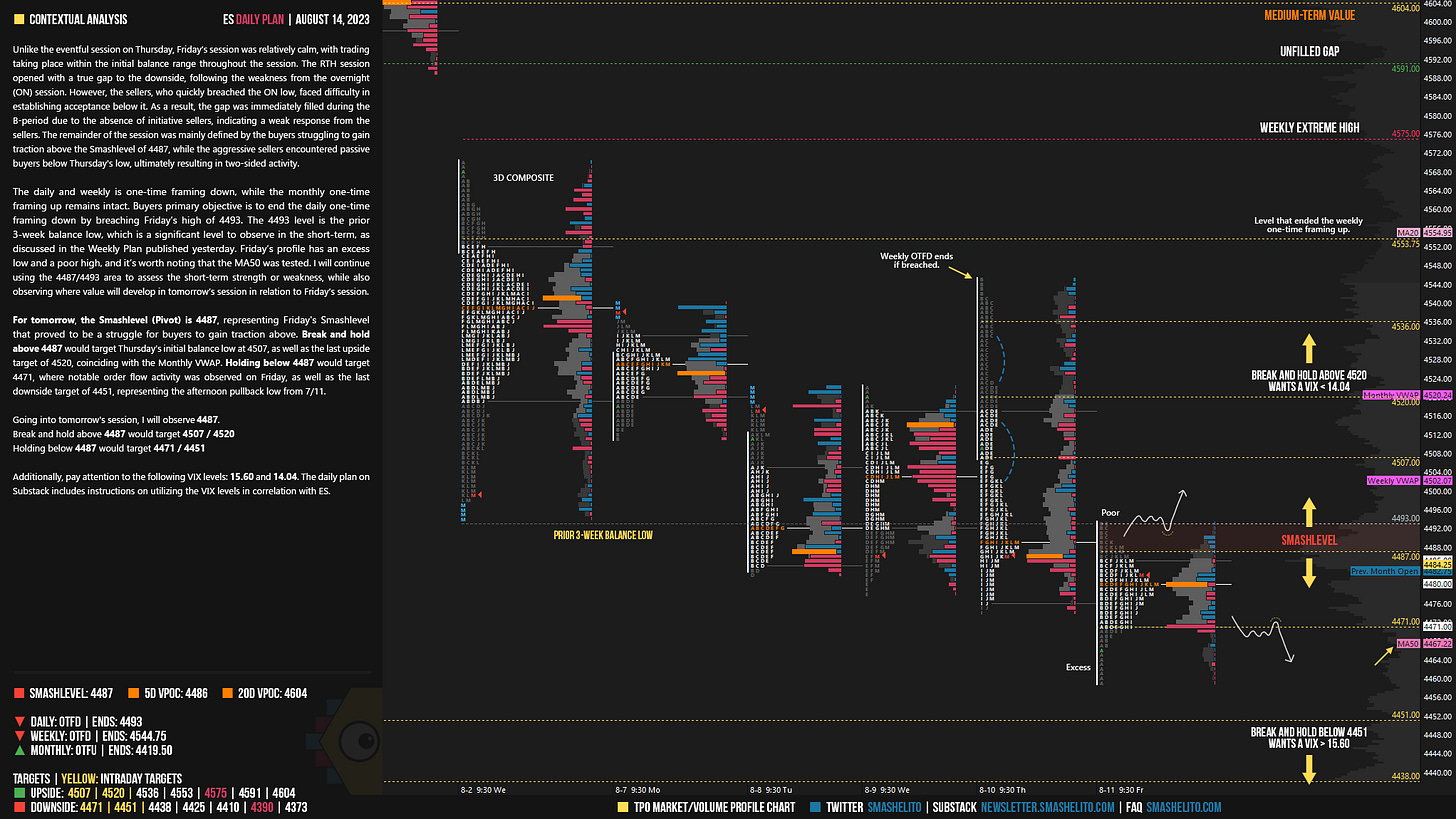

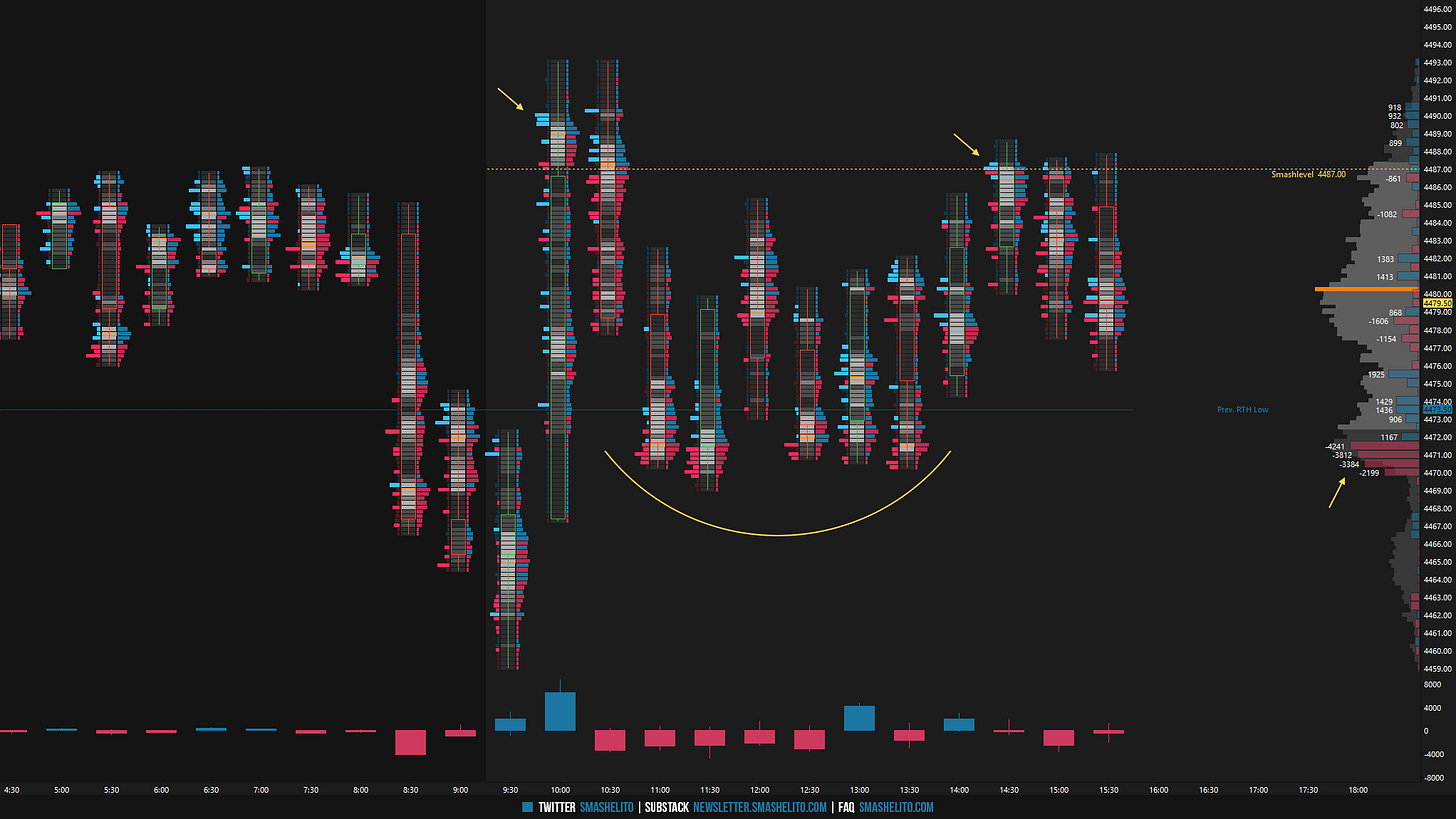

Unlike the eventful session on Thursday, Friday’s session was relatively calm, with trading taking place within the initial balance range throughout the session. The RTH session opened with a true gap to the downside, following the weakness from the overnight (ON) session. However, the sellers, who quickly breached the ON low, faced difficulty in establishing acceptance below it. As a result, the gap was immediately filled during the B-period due to the absence of initiative sellers, indicating a weak response from the sellers. The remainder of the session was mainly defined by the buyers struggling to gain traction above the Smashlevel of 4487, while the aggressive sellers encountered passive buyers below Thursday's low, ultimately resulting in two-sided activity.

The daily and weekly is one-time framing down, while the monthly one-time framing up remains intact. Buyers primary objective is to end the daily one-time framing down by breaching Friday’s high of 4493. The 4493 level is the prior 3-week balance low, which is a significant level to observe in the short-term, as discussed in the Weekly Plan published yesterday. Friday’s profile has an excess low and a poor high, and it’s worth noting that the MA50 was tested. I will continue using the 4487/4493 area to assess the short-term strength or weakness, while also observing where value will develop in tomorrow’s session in relation to Friday’s session.

For tomorrow, the Smashlevel (Pivot) is 4487, representing Friday's Smashlevel that proved to be a struggle for buyers to gain traction above. Break and hold above 4487 would target Thursday’s initial balance low at 4507, as well as the last upside target of 4520, coinciding with the Monthly VWAP. Holding below 4487 would target 4471, where notable order flow activity was observed on Friday, as well as the last downside target of 4451, representing the afternoon pullback low from 7/11.

Going into tomorrow's session, I will observe 4487.

Break and hold above 4487 would target 4507 / 4520

Holding below 4487 would target 4471 / 4451

Additionally, pay attention to the following VIX levels: 15.60 and 14.04. These levels can provide confirmation of strength or weakness.

Break and hold above 4520 with VIX below 14.04 would confirm strength.

Break and hold below 4451 with VIX above 15.60 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

50ma tagged 👍

Thank you smash!!