ES Daily Plan | April 4, 2023

The market dynamics haven't seen much change after today's session, with buyers still maintaining short-term control.

The main objective of the sellers is to break the pattern of higher lows by ending the daily OTFU.

Contextual Analysis

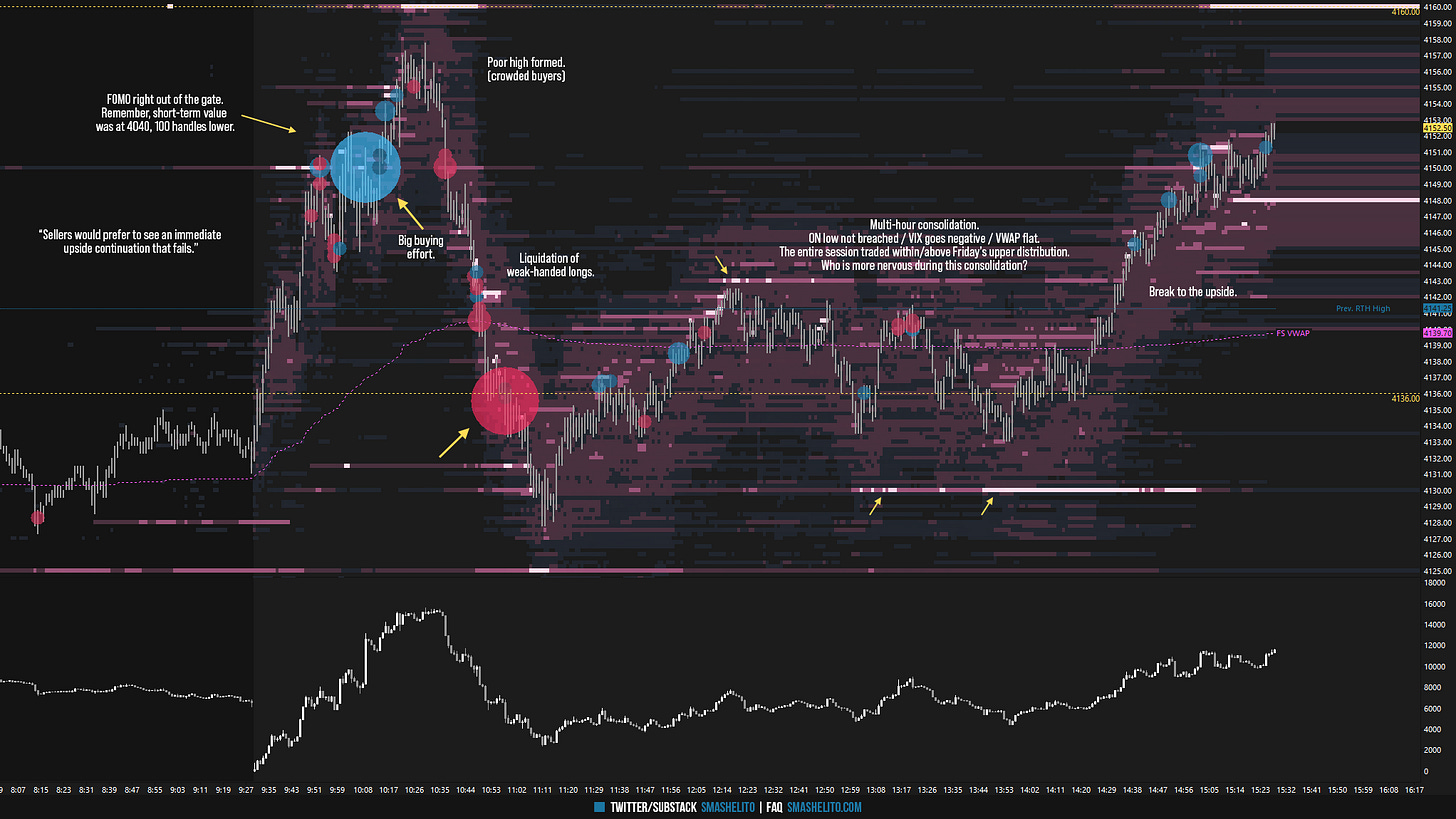

During the overnight (ON) session, trading remained uneventful as prices stayed within Friday's upper distribution. Despite their efforts, sellers were not able to push prices below the Smashlevel of 4122, with the ON low only reaching 4122.75. This low remained intact throughout today's session. The VIX breached the resistance level of 19.60 in the ON session, but just before the RTH session open, it dropped back below.

In my previous daily plan, I mentioned that sellers would prefer to see an immediate upside continuation that fails, rather than immediate weakness. The market started to rally right out of the gate in the RTH session, stopping out the overnight sellers, breaching previous week’s high in the process. Although buyers would have preferred to capitalize on immediate weakness, given that the short-term value (5-day VPOC) was 100 handles lower prior to the session, the market continued to rally, resulting in a relatively large initial balance range. However, the buyers were unable to sustain the upward continuation and formed a poor high, signaling crowded buyers. During the C-period, the sellers aggressively capitalized on this situation, resulting in a negative delta of 10624. The selling pressure during this period did not cause significant damage to buyers, who welcomed it and took the opportunity to buy. When it comes to liquidation breaks in uptrends, they tend to get filled, making it challenging to chase them. Following the unsuccessful attempts to extend the range on both sides of the initial balance, the market consolidated for several hours at the upper end of Friday's range. The question was who was feeling the most nervous during the consolidation phase. Throughout this period, the ON low remained unbroken, the VIX turned negative, and the VWAP remained relatively flat. It came as no surprise that the breakout from this consolidation occurred in the direction of the short-term uptrend.

The market dynamics haven't seen much change after today's session, with buyers still maintaining short-term control. The existing poor structure from below is being carried forward, but it will only become significant when there are indications of weakness. I have added a composite profile that highlights the market structure from the last three sessions. The primary objective of the sellers is to break the pattern of higher lows by ending the daily one time framing up, which could lead to fills of the highlighted poor structure. As previously mentioned, today's session formed a poor high, suggesting that buyers may be becoming exhausted. Buyers main objective was to spend time and volume at these higher prices to migrate the value higher. The short-term value (5-day VPOC) has now shifted from 4041 to 4138, which is an important high volume node in the short-term. However, I am particularly interested in today's low volume node (LVN) of 4143 as my short-term level of interest.

Going into tomorrow's session, I will observe 4143.

Break and hold above 4143 would target 4160 / 4175 / 4192

Holding below 4143 would target 4122 / 4112

Additionally, pay attention to the following VIX levels: 19.44 and 17.66. These levels can provide confirmation of strength or weakness.

Break and hold above 4192 with VIX below 17.66 would confirm strength.

Break and hold below 4112 with VIX above 19.44 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

thank u