ES Daily Plan | April 28, 2023

Today’s session resulted in a multi-distribution trend day with six (!) sets of single prints, indicating very poor structure.

The expectation is to see fills of that structure. The lack of it is a bullish indication.

Contextual Analysis

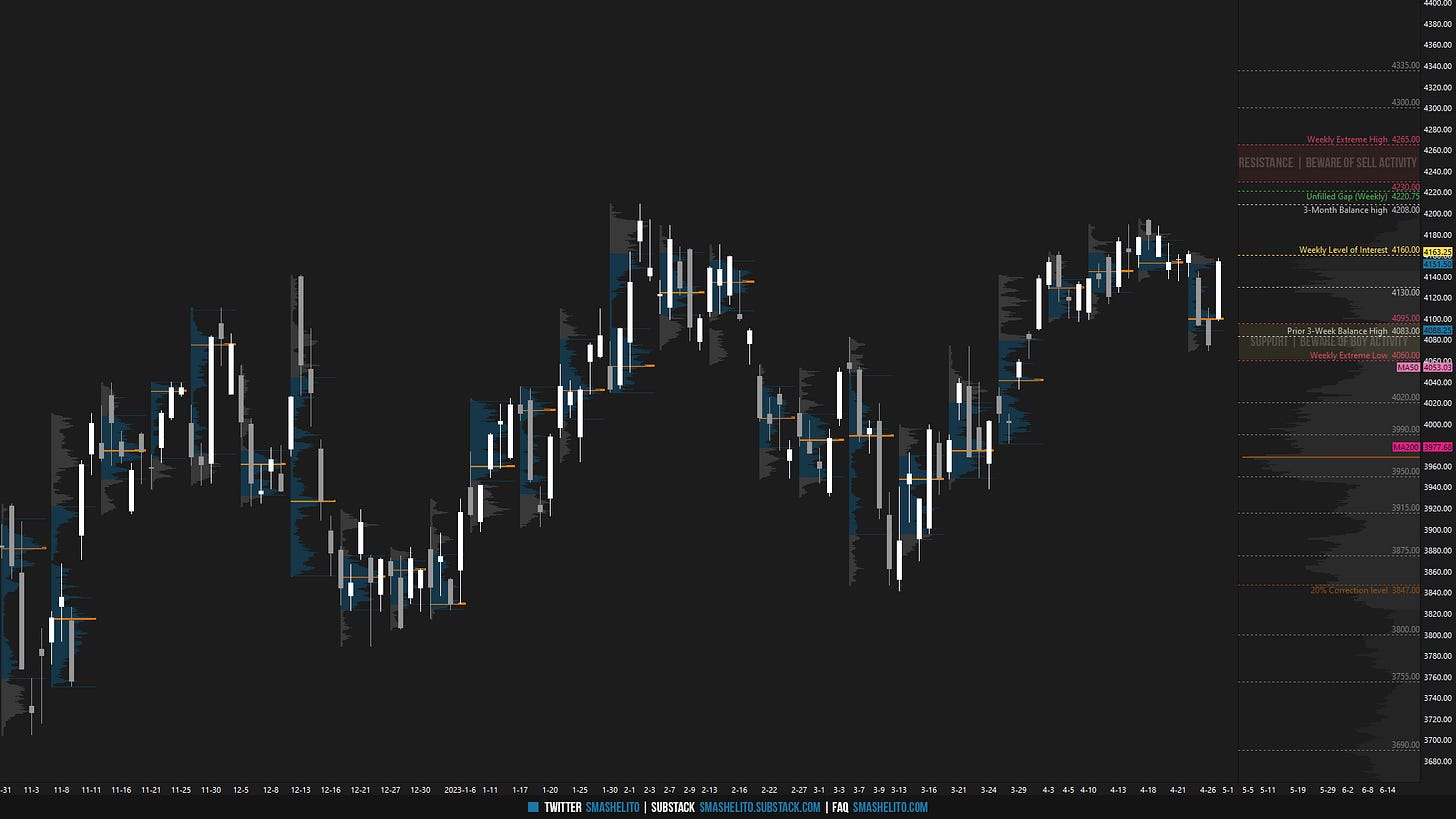

The previous session traded within the weekly support area highlighted in the Weekly Plan, published last Saturday. As we discussed in previous plan, it’s very tricky to chase the downside when the market is nearing the Weekly Extreme Low of 4060. Today's session served as a good example of why I am cautious about emotionally-driven decisions at unfavorable locations. The Weekly Plan provides a broader perspective, which highlights areas where I am cautious about initiating trades, both above and below (The Weekly Extremes).

In the RTH session, the market opened precisely at 4100, and the initial drop saw buying activity at the value area high from the ON session. The VIX breached its support level of 17.80 immediately at open, which was noteworthy. This nuance helped the buyers in reaching the last intraday upside target of 4117. The market was one time framing up intraday for the first three periods and a poor high developed in B/C-period, indicating crowded buyers. This often leads to a reaction where prices move away from that area to shake out those weak longs. This pullback was the most interesting sequence of the session because the VIX was holding below 17.80, confirming the strength of the market. This means that it was risky to chase the shorts contextually. Reversals are more appealing if the market reaches the last upside target without VIX confirming its strength, as known. It came as no surprise that buyers found the pullback appealing. There should be no fading once ES > 4117 and VIX < 17.80. I will share a separate recap of my only trade, which was this sequence, on Substack.

Today’s session resulted in multi-distribution trend day with six (!) sets of single prints, indicating very poor structure. Note that this poor structure is situated within the value of the multi-day composite, which raises the likelihood of fills compared to scenarios where we break out of balance areas with poor structure. Lack of interest of fills is a bullish indication. The daily has returned to a 4-day balance and today’s high is poor. As discussed, the short and medium-term value remained at 4153 before the session. It's interesting to observe how the sellers' inability to establish value lower resulted in a move back to 4153 today. Although we discussed the possibility of a "Sometimes the market has to break before it can rally" scenario in the Weekly Plan, we shouldn't overreact after today's session. Now that the market is back to value, it's essential to remain flexible and navigate day by day.

Going into tomorrow's session, I will observe 4141.

Holding above 4141 would target 4161 / 4180 / 4194

Break and hold below 4141 would target 4127 / 4117

Additionally, pay attention to the following VIX levels: 17.96 and 16.06. These levels can provide confirmation of strength or weakness.

Break and hold above 4194 with VIX below 16.06 would confirm strength.

Break and hold below 4117 with VIX above 17.96 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

The quality of this newsletter is something else! Thanks for all the effort you put into it.

This is an amazing resource. My first time using it today - the levels are just amazing. Thank you for all you do!