ES Daily Plan | April 27, 2023

Downside continuation for sellers after preventing the buyers from regaining acceptance within yesterday's upper distribution.

The sellers remain in short-term control as long as the daily OTFD is intact.

Contextual Analysis

Both the overnight (ON) session and the regular trading hours (RTH) focused primarily on the highlighted poor structure observed during yesterday's double distribution trend day to the downside. The sellers accomplished their primary objective of preventing the buyers from regaining acceptance within the upper distribution. During the overnight session, the buyers filled the poor structure, but the sellers stepped in at 4116.25, which was 3 ticks below the Smashlevel of 4117. The rejection at 4117 allowed the sellers to explore prices below yesterday's low during the European session.

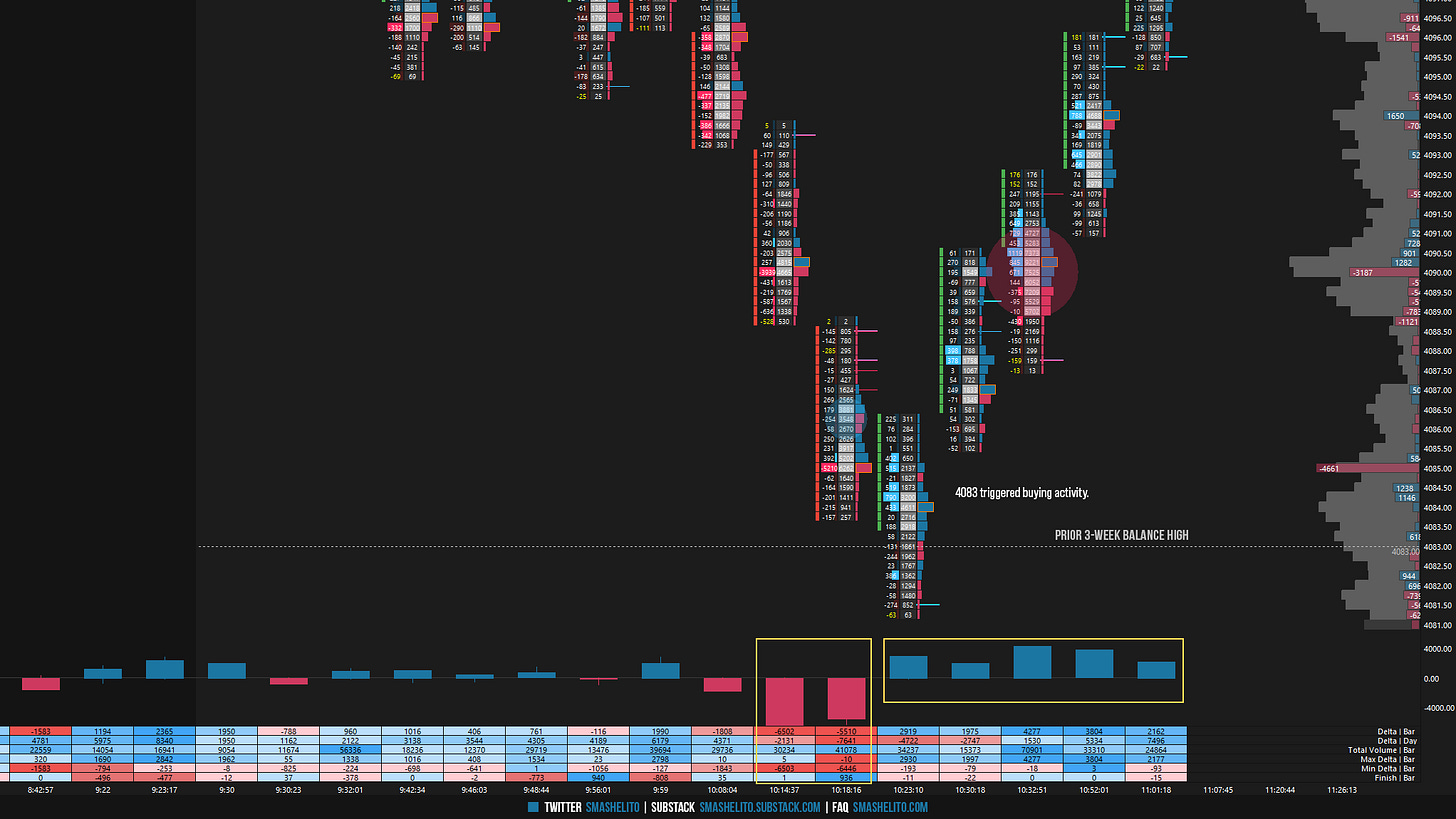

The RTH opened above yesterday’s spike base, and the A-period was trading in a very tight range of 10 handles. Despite decent buying effort in A-period, the buyer were not able to gain traction. When the B-period opened, the sellers aggressively started to hit the bid, and they had no trouble gaining traction. A negative delta of 10K in B-period resulted in a test of the prior 3-week balance high at 4083, which those following my plans are well-informed about. Reaching the level of 4083 triggered buying activity, which resulted in a solid reversal of ~30 handles.

Similar to the overnight (ON) session, the reversal, fueled by short-covering, resulted in price being rejected while testing the poor structure that separated yesterday's double distribution. It's important to remember that the poor structure is an area where buyers are trapped. As a result, it may not be the best area to initiate new longs, as trapped buyers are likely to use any testing of the area as an opportunity to get out. With acceptance above 4117, it’s another story. Late buyers got trapped in a beautiful P-shaped candle, which was followed by aggressive sellers confirming the reversal.

The VIX was approaching the support level of 17.70, printing a low of 17.87 during that sequence. From that point on, the sellers were able to maintain control of the auction fairly well, and their target was a downside continuation towards the Weekly Extreme Low of 4060, which was almost achieved with a daily low of 4068.75.

As the market is trading within the weekly support area, highlighted in the Weekly Plan, and also nearing the Weekly Extreme Low of 4060, it gets a little tricky to chase the downside. The concept of the Weekly Extremes are similar to the yellow intraday targets. I personally exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. I prefer to let other traders do that price discovery. At the same time, refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction. The sellers remain in control as long as the daily OTFD is intact. The most bearish scenario would involve breaking below 4060 and establishing value below it, which is what the sellers are aiming for. The buyers aim to primarily regain 4083 to start fighting their way back inside the value are of the 12-day composite profile. It’s worth noting that both the short and medium-term value remains at 4153.

Going into tomorrow's session, I will observe 4083.

Break and hold above 4083 would target 4100 / 4117

Holding below 4083 would target 4070 / 4060 / 4141 / 4025

Additionally, pay attention to the following VIX levels: 19.88 and 17.80. These levels can provide confirmation of strength or weakness.

Break and hold above 4117 with VIX below 17.80 would confirm strength.

Break and hold below 4025 with VIX above 19.88 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you for all the great work you are doing! Very professional and consistent! Learning a lot from you!

Great analysis as always. I am curious what VIX you use. I use the futures continuous contract and its nowhere near 17.