ES Daily Plan | April 26, 2023

Today’s session resulted in a double distribution trend day to the downside, and a downward spike in M-period.

The market tested the highlighted poor structure (LVN), and thus far, responding in an interesting way.

Contextual Analysis

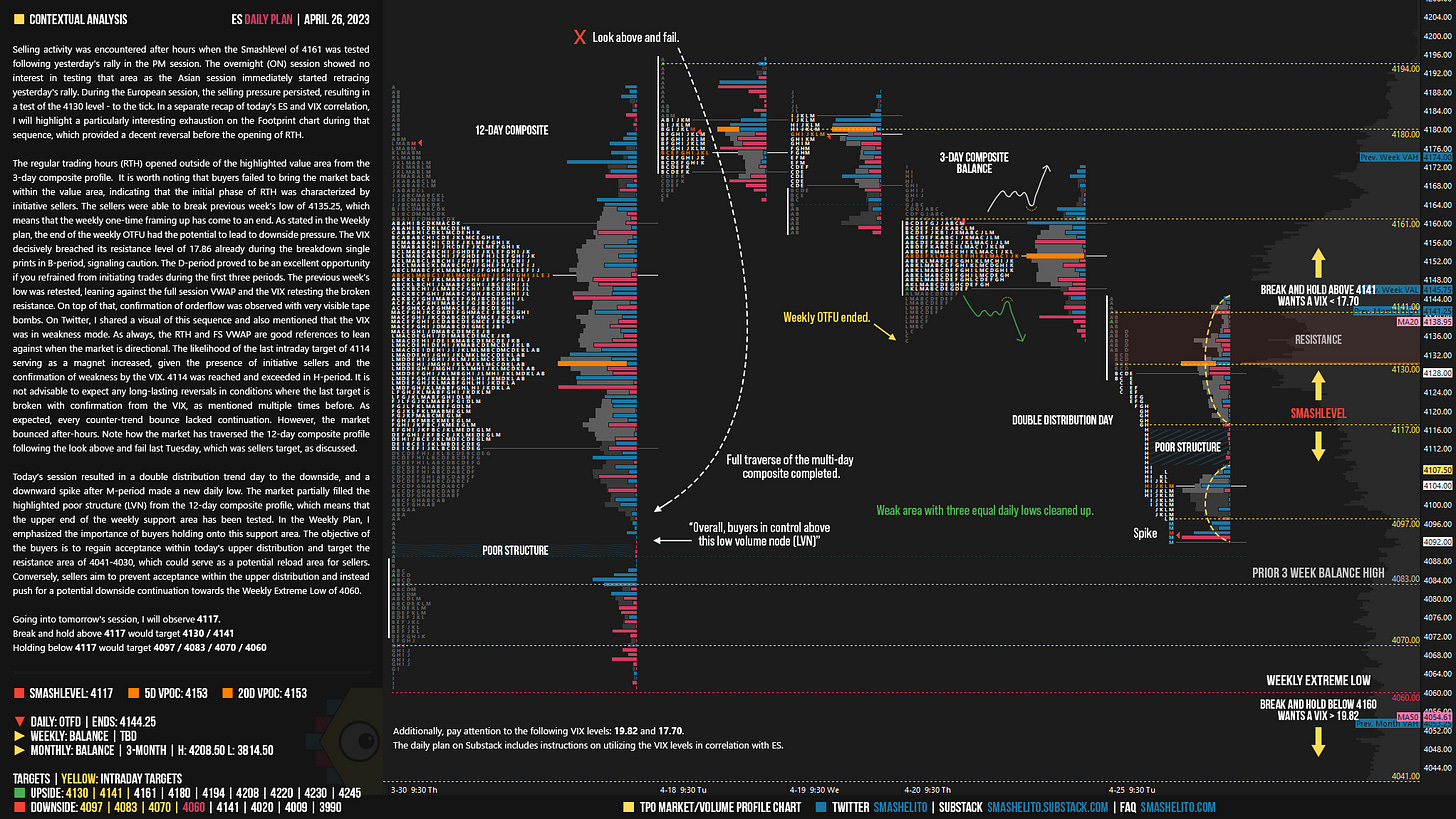

Selling activity was encountered after hours when the Smashlevel of 4161 was tested following yesterday's rally in the PM session. The overnight (ON) session showed no interest in testing that area as the Asian session immediately started retracing yesterday's rally. During the European session, the selling pressure persisted, resulting in a test of the 4130 level - to the tick. In a separate recap of today's ES and VIX correlation, I will highlight a particularly interesting exhaustion on the Footprint chart during that sequence, which provided a decent reversal before the opening of RTH.

The regular trading hours (RTH) opened outside of the highlighted value area from the 3-day composite profile. It is worth noting that buyers failed to bring the market back within the value area, indicating that the initial phase of RTH was characterized by initiative sellers. The sellers were able to break previous week’s low of 4135.25, which means that the weekly one-time framing up has come to an end. As stated in the Weekly plan, the end of the weekly OTFU had the potential to lead to downside pressure. The VIX decisively breached its resistance level of 17.86 already during the breakdown single prints in B-period, signaling caution. The D-period proved to be an excellent opportunity if you refrained from initiating trades during the first three periods. The previous week’s low was retested, leaning against the full session VWAP and the VIX retesting the broken resistance. On top of that, confirmation of orderflow was observed with very visible tape bombs. On Twitter, I shared a visual of this sequence and also mentioned that the VIX was in weakness mode.

As always, the RTH and FS VWAP are good references to lean against when the market is directional. The likelihood of the last intraday target of 4114 serving as a magnet increased, given the presence of initiative sellers and the confirmation of weakness by the VIX. 4114 was reached and exceeded in H-period. It is not advisable to expect any long-lasting reversals in conditions where the last target is broken with confirmation from the VIX, as mentioned multiple times before. As expected, every counter-trend bounce lacked continuation. However, the market bounced after-hours. Note how the market has traversed the 12-day composite profile following the look above and fail last Tuesday, which was sellers target, as discussed.

Today’s session resulted in a double distribution trend day to the downside, and a downward spike after M-period made a new daily low. The market partially filled the highlighted poor structure (LVN) from the 12-day composite profile, which means that the upper end of the weekly support area has been tested. In the Weekly Plan, I emphasized the importance of buyers holding onto this support area. The objective of the buyers is to regain acceptance within today's upper distribution and target the resistance area of 4141-4130, which could serve as a potential reload area for sellers. Conversely, sellers aim to prevent acceptance within the upper distribution and instead push for a potential downside continuation towards the Weekly Extreme Low of 4060.

Going into tomorrow's session, I will observe 4117.

Break and hold above 4117 would target 4130 / 4141

Holding below 4117 would target 4097 / 4083 / 4070 / 4060

Additionally, pay attention to the following VIX levels: 19.82 and 17.70. These levels can provide confirmation of strength or weakness.

Break and hold above 4141 with VIX below 17.70 would confirm strength.

Break and hold below 4060 with VIX above 19.82 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Great work as usual. That 4:30 am exhaustion was tricky. Play stupid games with VIX for weeks = this happens.

very helpful I'm starting to improve with profiling