ES Daily Plan | April 13, 2023

Today’s rejection from the multi-day balance high, resulted in an outside day down. As the market remains in balance, responsive trading remains the primary activity.

Contextual Analysis

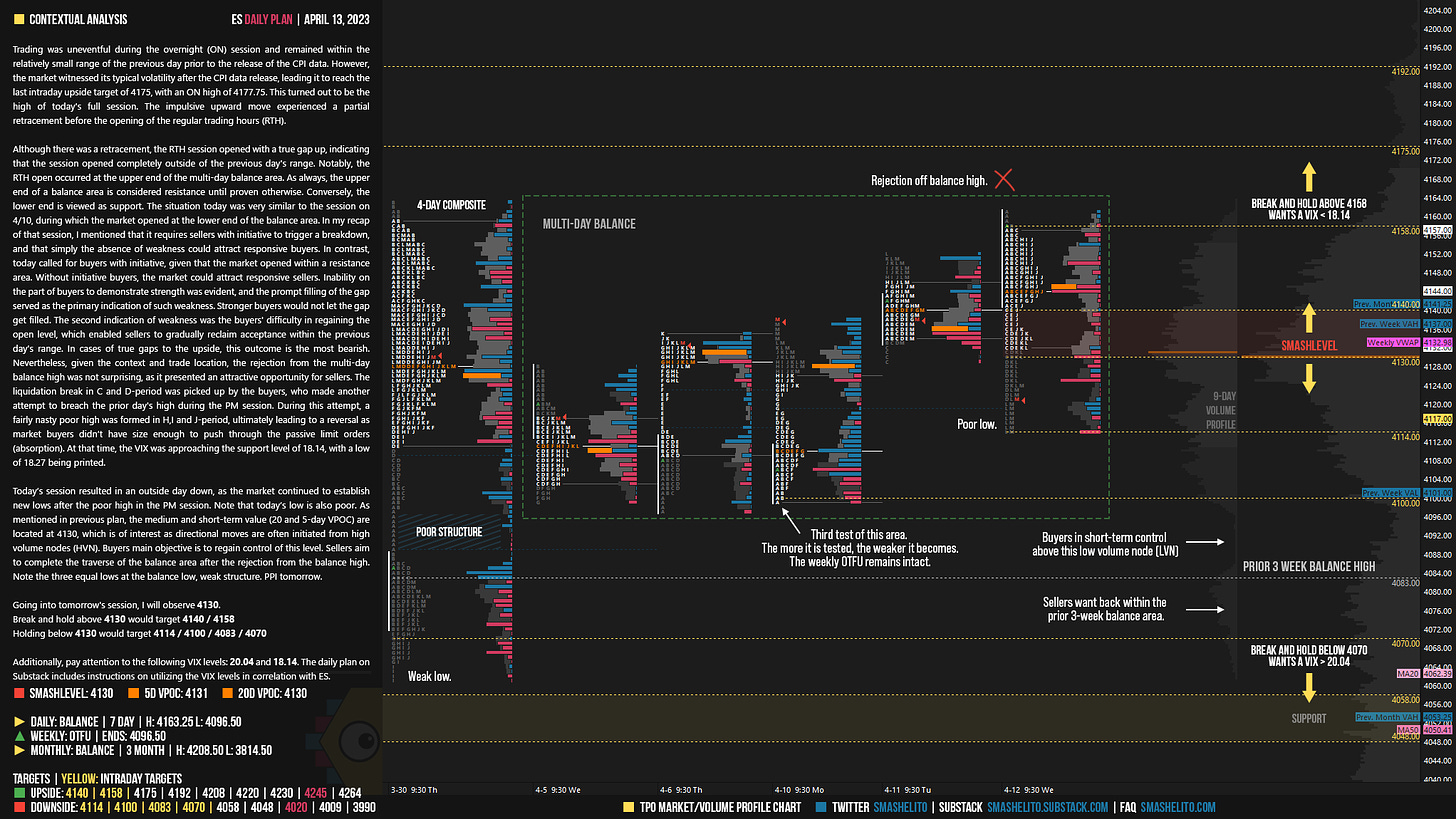

Trading was uneventful during the overnight (ON) session and remained within the relatively small range of the previous day prior to the release of the CPI data. However, the market witnessed its typical volatility after the CPI data release, leading it to reach the last intraday upside target of 4175, with an ON high of 4177.75. This turned out to be the high of today's full session. The impulsive upward move experienced a partial retracement before the opening of the regular trading hours (RTH).

Although there was a retracement, the RTH session opened with a true gap up, indicating that the session opened completely outside of the previous day's range. Notably, the RTH open occurred at the upper end of the multi-day balance area. As always, the upper end of a balance area is considered resistance until proven otherwise. Conversely, the lower end is viewed as support. The situation today was very similar to the session on 4/10, during which the market opened at the lower end of the balance area. In my recap of that session, I mentioned that it requires sellers with initiative to trigger a breakdown, and that simply the absence of weakness could attract responsive buyers. In contrast, today called for buyers with initiative, given that the market opened within a resistance area. Without initiative buyers, the market could attract responsive sellers. Inability on the part of buyers to demonstrate strength was evident, and the prompt filling of the gap served as the primary indication of such weakness. Stronger buyers would not let the gap get filled. The second indication of weakness was the buyers' difficulty in regaining the open level, which enabled sellers to gradually reclaim acceptance within the previous day's range. In cases of true gaps to the upside, this outcome is the most bearish. Nevertheless, given the context and trade location, the rejection from the multi-day balance high was not surprising, as it presented an attractive opportunity for sellers. The liquidation break in C and D-period was picked up by the buyers, who made another attempt to breach the prior day's high during the PM session. During this attempt, a fairly nasty poor high was formed in H,I and J-period, ultimately leading to a reversal as market buyers didn’t have size enough to push through the passive limit orders (absorption). At that time, the VIX was approaching the support level of 18.14, with a low of 18.27 being printed.

Today’s session resulted in an outside day down, as the market continued to establish new lows after the poor high in the PM session. Note that today’s low is also poor. As mentioned in previous plan, the medium and short-term value (20 and 5-day VPOC) are located at 4130, which is of interest as directional moves are often initiated from high volume nodes (HVN). Buyers main objective is to regain control of this level. Sellers aim to complete the traverse of the balance area after the rejection from the balance high. Note the three equal lows at the balance low, weak structure. PPI tomorrow.

Going into tomorrow's session, I will observe 4130.

Break and hold above 4130 would target 4140 / 4158

Holding below 4130 would target 4114 / 4100 / 4083 / 4070

Additionally, pay attention to the following VIX levels: 20.04 and 18.14. These levels can provide confirmation of strength or weakness.

Break and hold above 4158 with VIX below 18.14 would confirm strength.

Break and hold below 4070 with VIX above 20.04 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

How did you determine 4130 as the key level? Is it because VPOC from Monday was 4130, and the low from Tuesday is 4130?

Thanks Smash. Sellers on /NQ been in control since 4/4. Excess and IB extension then and today. Really starting to see the markets for what they are from your detailed recaps.