Daily Plan | February 20, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

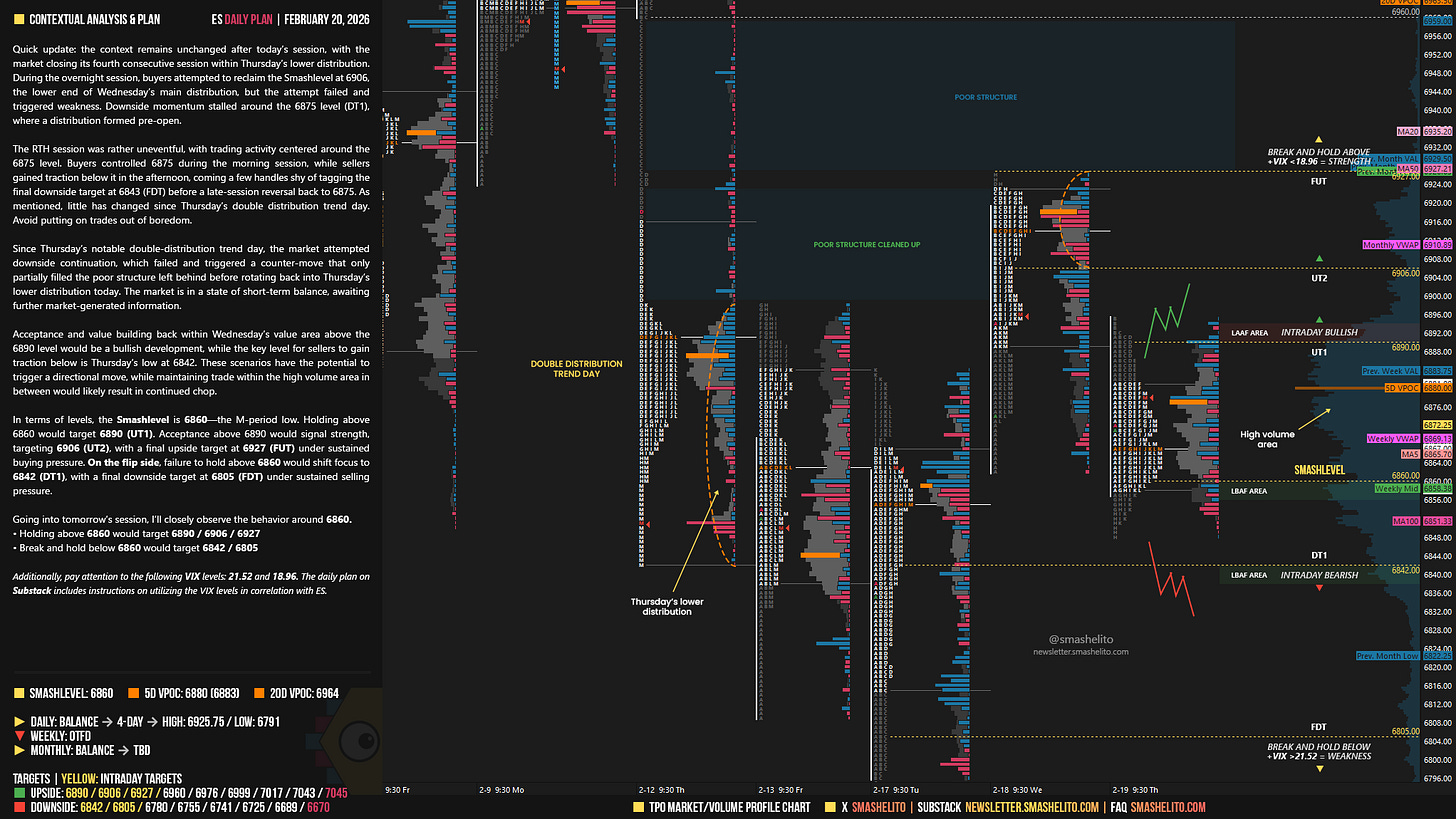

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Quick update: the context remains unchanged after today’s session, with the market closing its fourth consecutive session within Thursday’s lower distribution. During the overnight session, buyers attempted to reclaim the Smashlevel at 6906, the lower end of Wednesday’s main distribution, but the attempt failed and triggered weakness. Downside momentum stalled around the 6875 level (DT1), where a distribution formed pre-open.

The RTH session was rather uneventful, with trading activity centered around the 6875 level. Buyers controlled 6875 during the morning session, while sellers gained traction below it in the afternoon, coming a few handles shy of tagging the final downside target at 6843 (FDT) before a late-session reversal back to 6875. As mentioned, little has changed since Thursday’s double distribution trend day. Avoid putting on trades out of boredom.

Since Thursday’s notable double-distribution trend day, the market attempted downside continuation, which failed and triggered a counter-move that only partially filled the poor structure left behind before rotating back into Thursday’s lower distribution today. The market is in a state of short-term balance, awaiting further market-generated information.

Acceptance and value building back within Wednesday’s value area above the 6890 level would be a bullish development, while the key level for sellers to gain traction below is Thursday’s low at 6842. These scenarios have the potential to trigger a directional move, while maintaining trade within the high volume area in between would likely result in continued chop.

In terms of levels, the Smashlevel is 6860—the M-period low. Holding above 6860 would target 6890 (UT1). Acceptance above 6890 would signal strength, targeting 6906 (UT2), with a final upside target at 6927 (FUT) under sustained buying pressure.

On the flip side, failure to hold above 6860 would shift focus to 6842 (DT1), with a final downside target at 6805 (FDT) under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6860.

Holding above 6860 would target 6890 / 6906 / 6927

Break and hold below 6860 would target 6842 / 6805

Additionally, pay attention to the following VIX levels: 21.52 and 18.96. These levels can provide confirmation of strength or weakness.

Break and hold above 6927 with VIX below 18.96 would confirm strength.

Break and hold below 6805 with VIX above 21.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Unfortunately, yesterday I fell into the trap of boredom and feeling productive, returning the month's earnings. It's incredible that when you think you have your emotions under control, that's when you have to be most careful. You have to keep learning; mistakes are paid for with money or time. In this case, I took the money route. Pain + reflection = progress. Always grateful for your market perspective. Have a great session and an amazing weekend. May life always fill you with health and abundance.

Thanks Smash! The coil continues!