Daily Plan | February 18, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

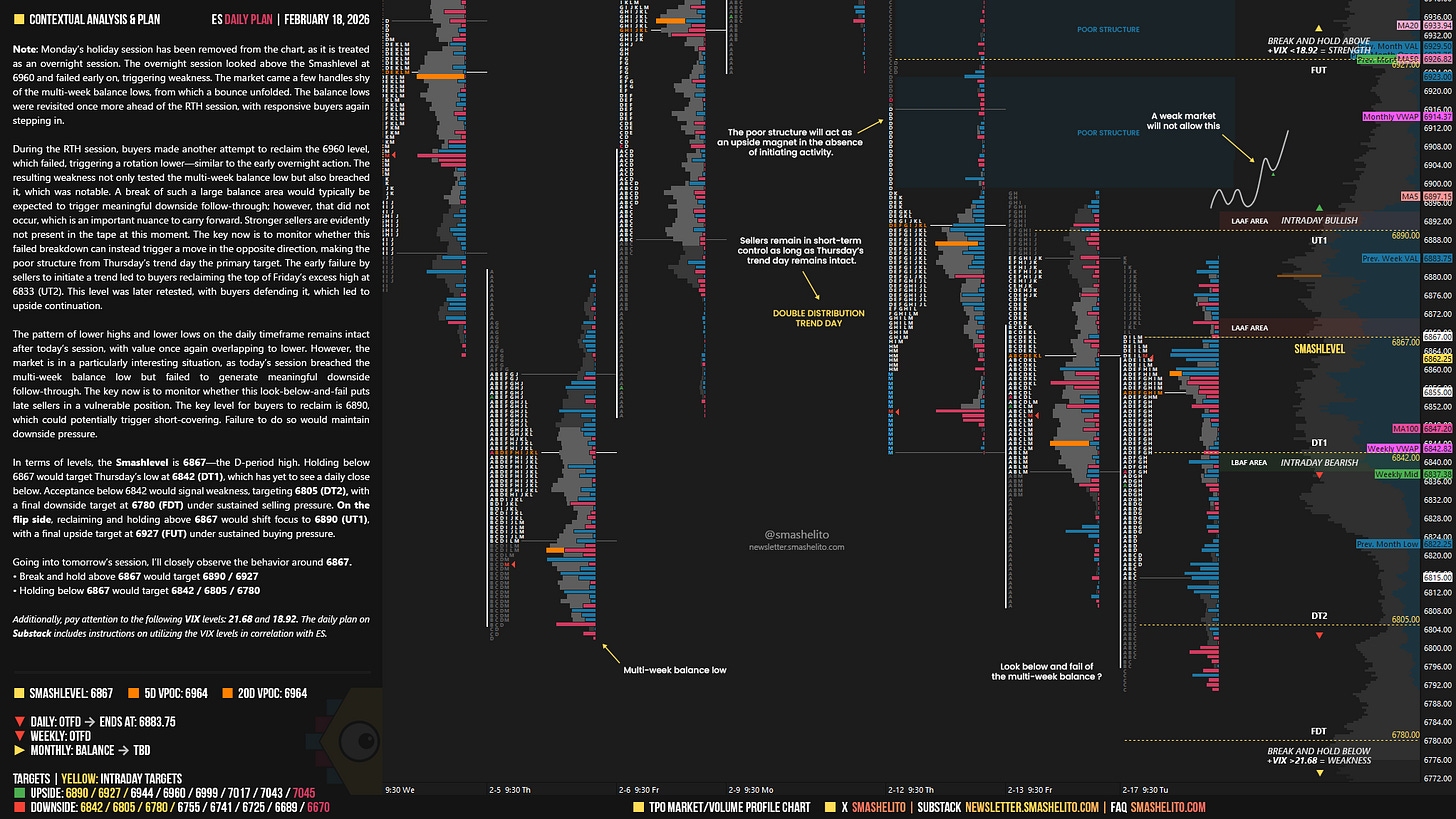

Note: Monday’s holiday session has been removed from the chart, as it is treated as an overnight session. The overnight session looked above the Smashlevel at 6960 and failed early on, triggering weakness. The market came a few handles shy of the multi-week balance lows, from which a bounce unfolded. The balance lows were revisited once more ahead of the RTH session, with responsive buyers again stepping in.

During the RTH session, buyers made another attempt to reclaim the 6960 level, which failed, triggering a rotation lower—similar to the early overnight action. The resulting weakness not only tested the multi-week balance low but also breached it, which was notable. A break of such a large balance area would typically be expected to trigger meaningful downside follow-through; however, that did not occur, which is an important nuance to carry forward. Stronger sellers are evidently not present in the tape at this moment. The key now is to monitor whether this failed breakdown can instead trigger a move in the opposite direction, making the poor structure from Thursday’s trend day the primary target. The early failure by sellers to initiate a trend led to buyers reclaiming the top of Friday’s excess high at 6833 (UT2). This level was later retested, with buyers defending it, which led to upside continuation.

The pattern of lower highs and lower lows on the daily timeframe remains intact after today’s session, with value once again overlapping to lower. However, the market is in a particularly interesting situation, as today’s session breached the multi-week balance low but failed to generate meaningful downside follow-through. The key now is to monitor whether this look-below-and-fail puts late sellers in a vulnerable position. The key level for buyers to reclaim is 6890, which could potentially trigger short-covering. Failure to do so would maintain downside pressure.

In terms of levels, the Smashlevel is 6867—the D-period high. Holding below 6867 would target Thursday’s low at 6842 (DT1), which has yet to see a daily close below. Acceptance below 6842 would signal weakness, targeting 6805 (DT2), with a final downside target at 6780 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6867 would shift focus to 6890 (UT1), with a final upside target at 6927 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6867.

Break and hold above 6867 would target 6890 / 6927

Holding below 6867 would target 6842 / 6805 / 6780

Additionally, pay attention to the following VIX levels: 21.68 and 18.92. These levels can provide confirmation of strength or weakness.

Break and hold above 6927 with VIX below 18.92 would confirm strength.

Break and hold below 6780 with VIX above 21.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash!

This blew my mind, Smash, "Holding below 6867 would target Thursday's low at 6842 (DT1), which has yet to see a daily close below." How the heck do you manage to keep track of everything? Sometimes I think it's a whole building delivering these newsletters!